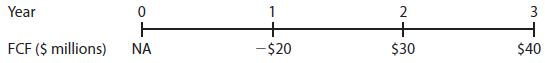

Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs)

Question:

Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s WACC is 13%.

a. What is Dozier’s terminal, or horizon, value?

b. What is the firm’s value today?

c. Suppose Dozier has $100 million of debt and 10 million shares of stock outstanding. What is your estimate of the current price per share?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: