Eli, Joe, and Ned agree to liquidate their consulting practice as soon as possible after the close

Question:

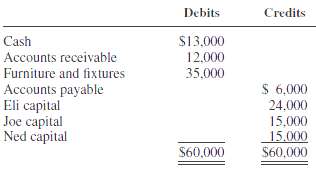

Eli, Joe, and Ned agree to liquidate their consulting practice as soon as possible after the close of business on July 31, 2011. The trial balance on that date shows the following account balances:

The partners share profits and losses 20 percent, 30 percent, and 50 percent to Eli, Joe, and Ned, respectively, after Ned is allowed a monthly salary of $4,000.August transactions and events are as follows:1. The accounts payable are paid.2. Accounts receivable of $8,000 are collected in full. Ned accepts accounts receivable with a face value and fair value of $3,000 in partial satisfaction of his capital balance. The remaining accounts receivable are written off as uncollectible.3. Furniture with a book value of $25,000 is sold for $15,000.4. Furniture with a book value of $4,000 and an agreed-upon fair value of $1,000 is taken by Joe in partial settlement of his capital balance. The remaining furniture and fixtures are donated to Goodwill Industries.5. Liquidation expenses of $3,000 are paid.6. Available cash is distributed to partners on August 31.REQUIREDPrepare a statement of partnership liquidation for the Eli, Joe, and Ned partnership for August.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith