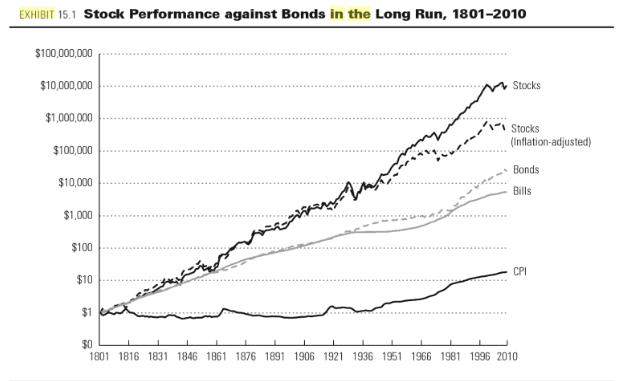

Exhibit 15.1 shows how (cumulative) returns on investments in the equity market index have consistently exceeded returns

Question:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Valuation Measuring and managing the values of companies

ISBN: ?978-0470424704

5th edition

Authors: Mckinsey, Tim Koller, Marc Goedhart, David Wessel

Question Posted: