Hathaway Health Club sold three-year memberships at a reduced rate during its opening promotion. It sold 1,000

Question:

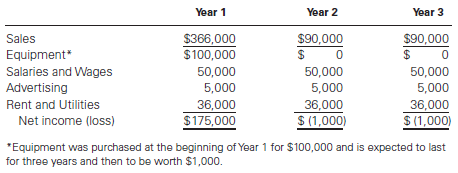

Hathaway Health Club sold three-year memberships at a reduced rate during its opening promotion. It sold 1,000 three-year nonrefundable memberships for $366 each. The club expects to sell 100 additional three-year memberships for $900 each over each of the next two years. Membership fees are paid when clients sign up. The club’s bookkeeper has prepared the following income statement for the first year of business and projected income statements for Years 2 and 3.

Cash-basis income statements:

Required

1. Convert the income statements for each of the three years to the accrual basis.

2. Describe how the revenue recognition principle applies. Do you believe that the cash-basis or the accrual-basis income statements are more useful to management? To investors? Why?

Step by Step Answer:

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1133161646

7th Edition

Authors: Gary A. Porter, Curtis L. Norton