Hightec Corporation has a seven-year contract with Magichip Company to supply 10,000 units of XT-12 at $5

Question:

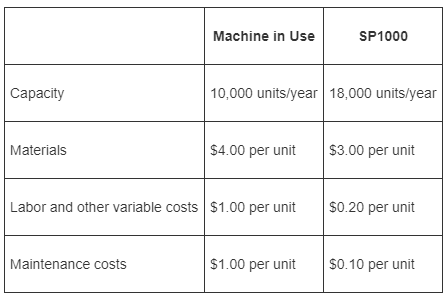

Hightec Corporation has a seven-year contract with Magichip Company to supply 10,000 units of XT-12 at $5 per unit. Increases in materials and other costs since signing the contract two years ago make this product a cash drain to Hightec. As the manager of the subsidiary that manufactures and sells XT-12, you have discovered that a new machine, SP1000, has a higher productivity. The following is a summary of pertinent information:

(For simplicity, assume that all revenues and expenses are received and paid at year-end.)

The current machine can be sold for $3,000 today. Its salvage value will be $1,000 if the firm continues to use the machine for another five years. The new machine costs $100,000, will be depreciated over a five-year life, and will have a net disposal value of $5,000 in five years. The company’s after-tax cost of capital is 10 percent. If the company decides to keep the old machine, which is fully depreciated, production can continue with it for at least another five years. All machines are depreciated on a straight-line basis with no salvage value. (Assume, for simplicity, that MACRS depreciation rules do not apply.) The firm expects to continue to pay approximately 20 percent for both federal and state income taxes in the foreseeable future. At present the Magichip Company is the only user of XT-12.

Required

Compute:

1. The effects on the cash flow each year, including year 0, if the new machine is purchased.

2. The net present value (NPV) of the new machine.

3. The payback period of the new machine, under the assumption that cash inflows occur evenly throughout the year.

4. The internal rate of return (IRR) on the new machine, assuming that the new machine’s annual cash inflows are $25,000 and that neither the new machine nor the existing machine will have salvage value at the end of the five-year period.

5. The internal rate of return (IRR) assuming that the after-tax cash inflows are as follows and that the estimated salvage value for both machines at the end of five years is $0.

Year 1 ...........$20,000

Year 2 ........... 22,000

Year 3 ........... 25,000

Year 4 ........... 30,000

Year 5 ........... 40,000

6. By how much can the variable costs of the new machine increase (or decrease) and the company be indifferent on the replacement, assuming all the other costs will be asestimated?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins