In Parts I and II of this case, you performed preliminary analytical procedures and assessed acceptable audit

Question:

In Parts I and II of this case, you performed preliminary analytical procedures and assessed acceptable audit risk and inherent risk for Pinnacle Manufacturing. Your team has been assigned the responsibility of auditing the acquisition and payment cycle and one related balance sheet account, accounts payable. The general approach to be taken will be to reduce assessed control risk to a low level, if possible, for the two main types of transactions affecting accounts payable:

acquisitions and cash disbursements. The following are furnished as background information:

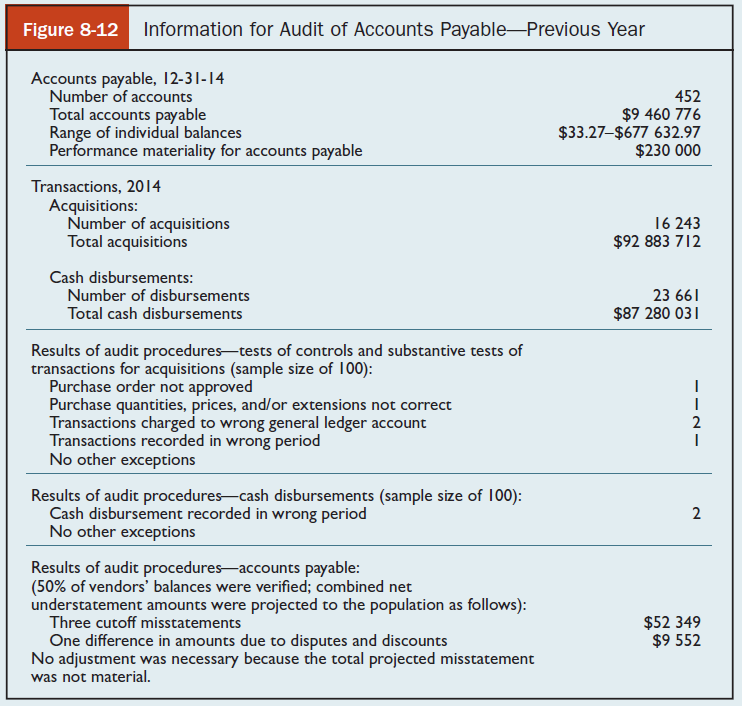

• A summary of key information from the audit of the acquisition and payment cycle and accounts payable in the prior year, which was extracted from the previous audit firm's audit files ( Figure 8-12 ).

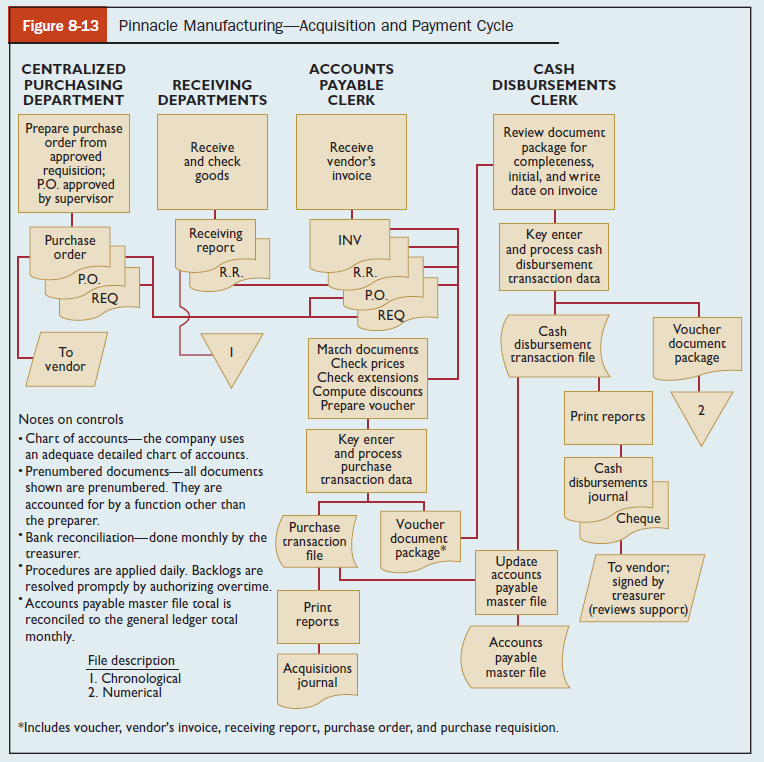

• A flowchart description of the accounting system and internal controls for the acquisition and payment cycle ( Figure 8-13 ). The flowchart shows that although each of the company's three divisions has its own receiving department, the purchasing and accounts payable functions are centralized.

The purpose of Part III is to obtain an understanding of internal control and assess control risk for Pinnacle Manufacturing's acquisition and cash disbursement transactions.

REQUIRED

a. Familiarize yourself with the internal control system for acquisitions and cash disbursements by studying the information in Figure 8-12 and Figure 8-13 .

b. Prepare a control risk matrix for acquisitions and a separate one for cash disbursements. A formatted control risk matrix is provided on the textbook website. The objectives should be specific transaction-related audit objectives for acquisitions for the first matrix and cash disbursements for the second matrix. See Chapter 13 for transaction-related audit objectives for acquisitions and cash disbursements. In doing Part III , the following steps are recommended:

(1) Controls

a. Identify key controls for acquisitions and for cash disbursements. After you decide on the key controls, include each control in one of the two matrices.

b. Include a "C" in the matrix in each column for the objective(s) to which each control applies. Several of the controls should satisfy multiple objectives.

(2) Deficiencies a. Identify key deficiencies for acquisitions and for cash disbursements. After you decide on the deficiencies, include each deficiency in the bottom portion of one

of the two matrices.

b. Include a "D" in the matrix in each column for the objective(s) to which each control deficiency applies. Assess control risk as high, medium, or low for each objective using your best judgment. Do this for both the acquisitions and cash disbursements matrices.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Auditing The Art and Science of Assurance Engagements

ISBN: 978-0133405507

13th Canadian edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Joanne C. Jones