In the course of the audit of Brand Drug Limited (BDL), the CA, while reviewing the draft

Question:

In the course of the audit of Brand Drug Limited (BDL), the CA, while reviewing the draft financial statements for the year ended August 31, 20X6, noticed that BDL’s investment in National Pharmaceuticals Limited (NPL) was valued on the cost basis. In 20X5, it had been valued on the equity basis. Representing a 22% interest in NPL, this investment had been made 10 years ago to infuse fresh equity into NPL, with a view to protecting BDL’s source of supply for drugs.

BDL’s controller informed CA that NPL had suffered a large loss in 20X6, as shown by the May interim financial statements. BDL’s representative on NPL’s board of directors had resigned because BDL’s purchases from NPL now constituted less than 5% of its total purchases. In addition, NPL had been uncooperative in providing profit data in time to make the year-end equity adjustment. Consequently, BDL’s controller had revised the method of accounting for the investment in NPL.

CA then found out that BDL’s managers are planning a share issue in 20X7 and do not want their earnings impaired by NPL’s poor performance. However, they are reluctant to divest themselves of NPL in case the rumored development by NPL of a new drug to reduce the impact of colitis materializes.

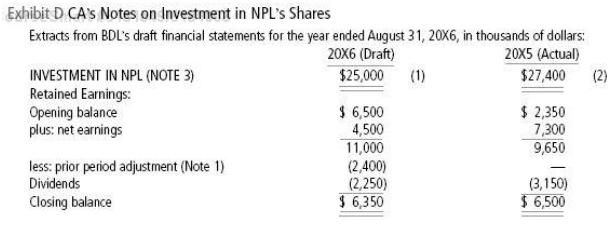

When CA approached NPL’s managers, they refused to disclose any information on NPL’s operations. CA then learned from a stockbroker friend that NPL’s poor results were due to its market being undercut by generic drug manufacturers. The loss had been increased when NPL’s management wrote off most of NPL’s intangible assets. CA summarized the relevant information on the treatment of the investment for his audit file (Exhibit D).

Note 1: Represents original cost. The 20X5 balance has been reduced by the amount of previously recorded equity interest of $ 2.4 million. In the nine months ended May 31, 20X6, NPL reported a net loss of $ 140 mil-lion after writing off development and patent costs as extraordinary items.

Note 2: Valued on equity basis. Equity adjustment for 20X5 involved the elimination of $ 5.5 million unrealized profit included in ending inventory, on sales from NPL to BDL. The unrealized profit in BDL’s ending inventory for 20X6 amounts to $ 1.5 million.

Note 3: Stock market trading in NPL’s common shares has been heavy in 20X6. Prices for the year are as follows:

August 31, 20X5:………………………………………….............................. $ 22.00

February 28, 20X6:………………………………………………………………... $ 4.00

August 31, 20X6:……………………………………………………………......... $ 12.00

BDL owns 2,000,000 common shares of NPL; in neither 20X5 nor 20X6 did NPL declare or pay any dividends.

Required

Discuss the matters raised above.

Intangible AssetsAn intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay