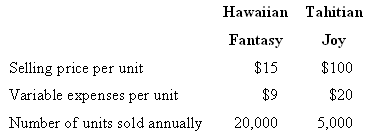

Island Novelties, Inc., of Palau makes two products, Hawaiian Fantasy and Tahitian Joy. Present revenue, cost, and

Question:

Island Novelties, Inc., of Palau makes two products, Hawaiian Fantasy and Tahitian Joy. Present revenue, cost, and sales data for the two products follow:

Fixed expenses total $475,800 per year. The Republic of Palau uses the U.S. dollar as its currency.

Required:

1. Assuming the sales mix given above, do the following:

a. Prepare a contribution format income statement showing both dollar and percent columns for each product and for the company as a whole.

b. Compute the break-even point in dollars for the company as a whole and the margin of safety in both dollars and percent.

2. The company has developed a new product to be called Samoan Delight. Assume that the company could sell 10,000 units at $45 each. The variable expenses would be $36 each. The company’s fixed expenses would not change.

a. Prepare another contribution format income statement, including sales of the Samoan Delight (sales of the other two products would not change).

b. Compute the company’s new break-even point in dollars and the new margin of safety in both dollars and percent.

3. The president of the company examines your figures and says, “There’s something strange here. Our fixed expenses haven’t changed and you show greater total contribution margin if we add the new product, but you also show our break-even point going up. With greater contribution margin, the break-even point should go down, not up. You’ve made a mistake somewhere.” Explain to the president what has happened.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer