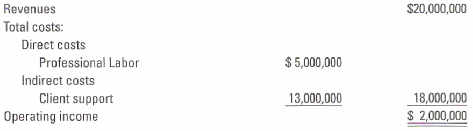

Job costing, consulting firm. Taylor & Associates, a consulting firm, has the following condensed budget for 2009:

Question:

Job costing, consulting firm. Taylor & Associates, a consulting firm, has the following condensed budget for 2009:

Taylor has a single direct-cost category (professional labor) and a single indirect-cost pool (client support). Indirect costs are allocated to jobs on the basis of professional labor costs.

1. Prepare an overview diagram of the job-costing system. Compute the 2009 budgeted indirect-cost rate for Taylor & Associates.

2. The markup rate for pricing jobs is intended to produce operating income equal to 10% of revenues. Compute the markup rate as a percentage of professional labor costs.

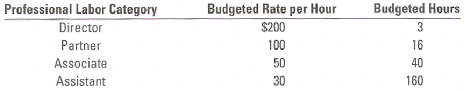

3. Taylor is bidding on a consulting job for Red Rooster, a fast-food chain specializing in poultry meats. The budgeted breakdown of professional labor on the job is as follows:

Compute the budgeted cost of the Red Rooster job. How much will Taylor bid for the job if it is to earn its target operating income of 10% of revenues?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav