John Calc Gosling is one of Canadas foremost real estate investment analysts. He works for the firm

Question:

John “Calc” Gosling is one of Canada’s foremost real estate investment analysts. He works for the firm of Bouchard Wiener Securities Inc. (BWS). His job is to do research and make recommendations on the stock of publicly traded companies, independent of any interest his employer may have in the companies. The research gets published and is used by investors in making their investment decisions. He is noted for his superb number- crunching ability, scathing comments, and accurate analysis. In late 19X4, he correctly predicted the end of the real estate bubble, which occurred about two years later. His writing style is in marked contrast to the traditional dry prose of most investment analysts.

Major Developments Corporation (Major) is a publicly traded company operating primarily in the real estate sector. Major has a March 31 year- end and in 20X5 reported revenues of $ 704 million and after- tax income of $ 118 million. The company buys and sells commercial real estate properties and manufactures commercial elevator components (its original business before it got into real estate). Major survived the recession of the 19X0s, and during that time purchased a number of commercial “jewels” at bargain prices. In 20X4, Major ventured overseas, acquiring properties in three Asian countries.

Major’s share price climbed steadily from 19X9 until July 11, 20X5. On that date BWS released a stunning research report by Gosling on Major (see extracts in Exhibit E). The report caused an uproar, as it claimed that many of Major’s accounting policies in 20X5 were misleading and therefore not in accordance with IFRS principles. It further claimed that the company was overvalued and had poor prospects because of its real estate port-folio mix.

The stock had been trading in the $ 15– 16 range but immediately dropped to around $ 9. BWS profited from the decline in the stock price because it held a significant short position in Major’s stock. Within four days, lawyers working for Major launched a legal suit against BWS, claiming damages plus a full retraction of all statements made to be published in a national newspaper.

BWS’s legal counsel is now examining various courses of action. To help prepare for the case, counsel has hired Brick & Mortar, Chartered Accountants, to provide a report on the validity of the positions of each of the parties on the disagreements over accounting policies as well as any other relevant advice. You, CA, work for Brick & Mortar. You have obtained a copy of Major’s 20X5 annual report (see extracts in Exhibit F). Major’s lawyers have provided the information in Exhibit G.

Required

Prepare a draft report to legal counsel for the partner to review.

Exhibit E Extracts from John Gosling’s Research Report

— I have done a detailed review of Major’s 20X5 annual reports. I approached management of the company with a detailed list of further questions, but management did not respond in the four days that I gave them.

— It is my contention that in 20X5, Major clearly violated IFRS principles on a number of issues. I am saying that the accounting is wrong, not just aggressive.

— Major’s accounting for its real estate loans really takes the cake for non- compliance. The company consolidates the assets and results of two corporations to whom it has granted loans when it does not own any shares in either of the two companies.

— I don’t like the accounting in Major’s non- real- estate business. There is no question it is misleading. Starting in 20X5, the company specifically states in the financial statement notes that revenue (and profit, I might add) is recognized on product that is still sitting in the company’s warehouse.

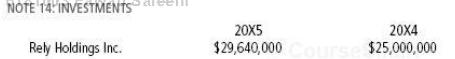

— How can Rely Holdings— a company that lost $ 750,000, in which Major had acquired an additional 25% interest for $ 5 million— be valued at over $ 29 million? The valuation of Rely Holdings makes no sense.

— How can a company capitalize costs incurred for properties that were never acquired? Clearly these costs cannot be considered assets, and it is misleading to do so.

— It is absurd that Major continues to recognize the revenue from properties in certain economically unstable Asian countries. It is unlikely that the money will be collected. Major should write off these buildings immediately instead of recognizing revenue from them.

Recommendation on Major Developments Corp.

Price earnings multiplier based on last fiscal year………………… 12.7

Overall rating on their stock………………………………………………... underperform

Recommendation……………………………………………….................... sell Exhibit F Extracts from Major Developments Corporation’s 20X5 Annual Report

NOTE 1: ACCOUNTING POLICIES

The company incurs significant costs in investigating new properties for purchase. Costs incurred in investigating any and all properties, whether or not these properties are ultimately purchased by the company, are capitalized as part of the cost of properties actually acquired. These costs are amortized over the useful lives of the properties acquired.

Economic problems in certain Asian countries where the company owns properties have made collection of rental revenues from these properties difficult at this time. The company expects that, once the difficulties in these countries have been resolved, amounts owed will be collected in full. It is the company’s policy to accrue the revenue from these properties.

Revenue on product sales is recognized when the goods are shipped to the customer. In the case of “bill and hold” sales, revenue is recognized when the goods are placed in the company’s designated storage area.

The consolidated financial statements include the accounts of Major and its majority-owned subsidiaries and, commencing prospectively in fiscal 20X5, the accounts of companies in which Major has no common share ownership but to which it has advanced loans that are currently in default. The equity method is used for investments in which there is significant influence, considered to be voting ownership of 20% to 50%..

In 20X0, Major purchased an additional 25% interest in Rely Holdings Inc. for $ 5 million. Major now owns 48% of Rely Holdings Inc. Major accounts for its investment on an equity basis. In 20X5, Major recorded a loss of $ 750,000 from Rely Holdings Inc.

Exhibit G Extracts from Information Provided by Major’s Lawyers

1. Major’s auditor has always provided an unqualified report on the audited financial statements of Major, including the 20X5 financial statements.

2. Major has a legal opinion that the two loans are in default (Item A), and a third- party opinion (Item B) that the default permits consolidation of these companies.

Item A “. . . In my opinion, loan 323 to Skyscraper Inc. and loan 324 to Wenon Corporation are in default as of February 1, 20X4, under the aforesaid terms of default of the respective loan agreements, dated the 12th day of August, 20X1. The lender has the right under law and contract to repossess said aforementioned properties, for the purposes of realization on the loans, subject to restrictions of right under clause 43. (b) . . . “[Matthew Krebs, Q. C.]

Item B “Based on facts set out in the attached document, we concur that it is acceptable, under international standards, for Major to consolidate Skyscraper Inc. and Wenon Corporation.” [Jesse & Mitchell, Chartered Accountants]

3. “Bill and hold” refers to a practice whereby a customer purchases goods but the seller retains physical possession until the customer requests shipment. Delivery is delayed at the purchaser’s request, but the purchaser accepts both the title to the goods and the related billing.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay