Kimberly-Clark Corporation manufactures and markets a variety of personal care and health products under brand names that

Question:

Kimberly-Clark Corporation manufactures and markets a variety of personal care and health products under brand names that include Kleenex, Buggies, Scott, Scottex, Cottonelle, Viva, Kotex, and WypAll. These products are sold worldwide. Founded in 1928, the firm is headquartered in Dallas, Texas, and has approximately 57,000 employees worldwide.

The firm is organized into four operating segments based on product groupings:

• Personal Care, which manufactures and markets disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, and related products. Products in this segment are primarily for household use and are sold under a variety of brand names, including Huggies, Pull-Ups, Little Swimmers, GoodNites, Kotex, Lightdays, Depend, Poise, and other brand names.

• Consumer Tissue, which manufactures and markets facial and bathroom tissue, paper towels, napkins, and related products for households use. Products in this segment are sold under the Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Hakle, Page, and other brand names.

• K-C Professional & Other, which manufactures and markets facial and bathroom tissue, paper towels, napkins, wipers, and a range of safety products for the away-from-home marketplace. Products in this segment are sold under the Kimberly-Clark, Kleenex, Scott, WypAll, Kimtech, KleenGuard, Kimcare, and Jackson brand names.

• Health Care, which manufactures and markets health care products such as surgical drapes and gowns, infection control products, face maks, exam gloves, respiratory products, pain management products, and other disposable medical products. Products in this segment are sold under the Kimberly-Clark, Ballard, ON-Q, and other brand names.

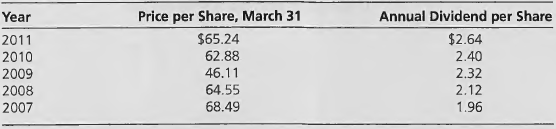

KMB closed the first quarter of2011 trading at $65.24 per share. You will find information of analysts' forecasts and opinions at the time in the first Continuing Case installment in Chapter l. Prices in earlier years and dividends paid over the prior 12 months are below:

Examine Kimberly-Clark's financial statements for fiscal year ending December 31, 2010, in Exhibit 2.2 with a view to testing your understanding of accounting: What do you not understand? The following questions will help you focus on the pertinent features:

A. Using the numbers in the financial statements, show that the following accounting relations hold in Kimberly-Clark's 2010 statements:

Shareholders' equity= Assets - Liabilities

Net income = Revenue - Expenses

Cash from operations + Cash from investment + Cash from financing + Effect of exchange rates = Change in cash and cash equivalents

B. What are the components of other comprehensive income for 2010? Show that the following accounting relation holds (approximately):

Comprehensive income =Net income + Other comprehensive income

C. Calculate the net payout to shareholders in 201 O from the Statement of Stockholders' Equity.

D. Explain how revenue is recognized.

E. Calculate the following for 2010: gross margin , effective tax rate, ebit, ebitda. Calculate the sales growth rate for 2010 and 2009.

F. Explain the difference between basic earnings per share and diluted earnings per share.

G. Explain why some inventory costs are in cost of goods sold and some are in inventory on the balance sheet.

H. Kimberly-Clark spent $698 million on advertising and promotion during 2010. Where is this cost included in the financial statements? Does this treatment satisfy the matching principle?

I. Kimberly-Clark spent $317 million on research and development in 2010. Where is this in the financial statements? Does this treatment satisfy the matching principle?

J. Accounts receivable for 2010 of$2,472 million is net of$80 million (reported in footnotes).

How is this calculation made?

K. Why are deferred income taxes both an asset and a liability?

L. What is "goodwill" and how is it accounted for? Why did it change in 2010?

M. Explain why there is a difference between net income and cash provided by operations.

N. What items in Kimberly-Clark's balance sheet would you say were close to fair market value?

0. Based on the stock price at March 31, 2011, calculate the market capitalization of the equity. Calculate the PIE ratio and the P/B ratio at this price. How do these ratios compare with historical PIE and P/B ratios in Figures 2.2 and 2.3?

P. From the price and dividend information above, calculate the stock rate-of-return for each year ending March 31, 2008-2011.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Statement Analysis and Security Valuation

ISBN: 978-0078025310

5th edition

Authors: Stephen Penman