Krogh Lumber's 2012 financial statements are shown here. a. Assume that the company was operating at full

Question:

Krogh Lumber's 2012 financial statements are shown here.

.png)

a. Assume that the company was operating at full capacity in 2012 with regard to all items except fixed assets; fixed assets in 2012 were being utilized to only 75% of capacity. By what percentage could 2013 sales increase over 2012 sales without the need for an increase in fixed assets?

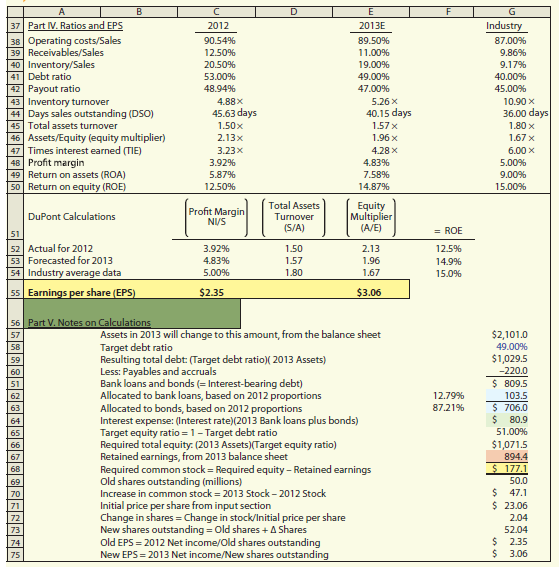

b. Now suppose 2013 sales increase by 25% over 2012 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its Operating costs/Sales ratio to 82% and increase its debt-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2013 total debt as notes payable, and it will issue bonds for the remainder. Its before-tax cost of debt is 11%. Any stock issuances or repurchases will be made at the firm's current stock price of $40. Develop Krogh's projected financial statements like those shown in Table 17.2. What are the balances of notes payable, bonds, common stock, and retained earnings?

Table 17.2

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-1133541141

13th edition

Authors: Eugene F. Brigham, Joel F. Houston