Labeau Products, Ltd., of Perth, Australia, has $35,000 to invest. The company is trying to decide between

Question:

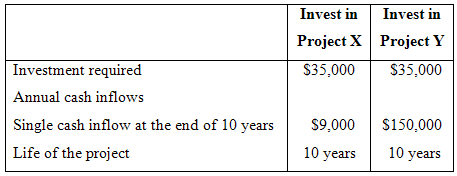

Labeau Products, Ltd., of Perth, Australia, has $35,000 to invest. The company is trying to decide between two alternative uses for the funds as follows:

The company’s discount rate is 18%.

Required:

(Ignore income taxes.) Which alternative would you recommend that the company accept? Show all computations using the net present value approach. Prepare separate computations for each project.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Question Posted: