Lydia Trottier has prepared baked goods for sale since 1998. She started a baking business in her

Question:

Lydia Trottier has prepared baked goods for sale since 1998. She started a baking business in her home and has been operating in a rented building with a storefront since 2003. Trottier incorporated the business as MLT Inc. on January 1, 2017, with an initial share issue of 1,000 common shares for $2,500. Lydia Trottier is the principal shareholder of MLT Inc.

Sales have increased by 30% annually since operations began at the present location, and additional equipment is needed for the continued growth that is expected. Trottier wants to purchase some additional baking equipment and to finance the equipment through a long-term note from a commercial bank. Fidelity Bank & Trust has asked Trottier to submit a statement of income for MLT Inc. for the first five months of 2017 and a statement of financial position as at May 31, 2017.

Trottier assembled the following information from the corporation’s cash basis records to use in preparing the financial statements that the bank wants to see:

1. The bank statement showed the following 2017 deposits through May 31:

Sale of common shares …………………………… $ 2,500

Cash sales ………………………………………… 22,770

Rebates from purchases ……………………………... 130

Collections on credit sales ………………………… 5,320

Bank loan proceeds …………………………….…. 2,880

…………………………………………………... $33,600

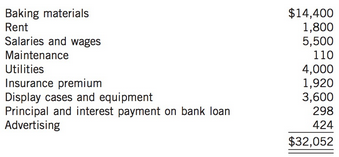

2. The following amounts were disbursed through May 31, 2017:

3. Unpaid invoices at May 31, 2017, were as follows:

Baking materials …………………………………. $256

Utilities ……………………………………………. 270

……………………………………………………. $526

4. Accounts receivable records showed uncollected sales of $4,336 at May 31, 2017.

5. Baking materials costing $2,075 were on hand at May 31, 2017. There were no materials in process or finished goods on hand at that date. No materials were on hand or in process and no finished goods were on hand at January 1, 2017.

6. The note for the three-year bank loan is dated January 1, 2017, and states a simple interest rate of 8%. The loan requires quarterly payments on April 1, July 1, October 1, and January 1. Each payment is to consist of equal principal payments [$2,880 ÷ (3 × 4) = $240] plus accrued interest since the last payment.

7. Lydia Trottier receives a salary of $750 on the last day of each month. The other employees have been paid through May 25, 2017, and are due an additional $270 on May 31, 2017.

8. New display cases and equipment costing $3,600 were purchased on January 2, 2017, and have an estimated useful life of five years with no residual value. These are the only fixed assets that are currently used in the business. Straight-line depreciation is used for book purposes.

9. Rent was paid for six months in advance on January 2, 2017.

10. A one-year insurance policy was purchased on January 2, 2017.

11. MLT Inc. is subject to an income tax rate of 20%. No tax instalments have been paid.

12. Payments and collections from the unincorporated business through December 31, 2016, were not included in the corporation’s records, and no cash was transferred from the unincorporated business to the corporation.

Instructions

(a) Using the accrual basis of accounting, prepare a statement of income for the five months ended May 31, 2017.

(b) Using the accrual basis, prepare a statement of financial position as at May 31, 2017.

*(c) Assume the role of a bank manager at Fidelity Bank & Trust. Based only on MLT’s current ratio as a measure of liquidity, and times interest earned ratio as a measure of MLT’s ability to pay interest, would you recommend extending a long-term note for financing of MLT’s purchase of additional baking equipment?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119048534

11th Canadian edition Volume 1

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy