Make versus buy, activity-based costing, opportunity costs. The Weaver Company produces gas grills. This year's expected production

Question:

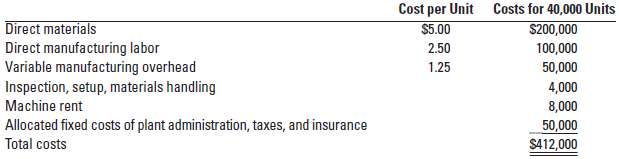

Make versus buy, activity-based costing, opportunity costs. The Weaver Company produces gas grills. This year's expected production is 20,000 units. Currently, Weaver makes the side burners for its grills. Each grill includes two side burners. Weaver's management accountant reports the following costs for making the 40,000 burners:

Weaver has received an offer from an outside vendor to supply any number of burners Weaver requires at $9.25 per burner. The following additional information is available:a. Inspection, setup, and materials-handling costs vary with the number of batches in which the burners are produced. Weaver produces burners in batch sizes of 1,000 units. Weaver will produce the 40,000 units in 40 batches.b. Weaver rents the machine used to make the burners. If Weaver buys all of its burners from the outside vendor, it does not need to pay rent on this machine.Required1. Assume that if Weaver purchases the burners from the outside vendor, the facility where the burners are currently made will remain idle. On the basis of financial considerations alone, should Weaver accept the outside vendor's offer at the anticipated volume of 40,000 burners? Show your calculations.2. For this question, assume that if the burners are purchased outside, the facilities where the burners are currently made will be used to upgrade the grills by adding a rotisserie attachment. (Note: Each grill contains two burners and one rotisserie attachment.) As a consequence, the selling price of grills will be raised by $30. The variable cost per unit of the upgrade would be $24, and additional tooling costs of $100,000 per year would be incurred. On the basis of financial considerations alone, should Weaver make or buy the burners, assuming that 20,000 grills are produced (and sold)? Show your calculations.3. The sales manager at Weaver is concerned that the estimate of 20,000 grills may be high and believes that only 16,000 grills will be sold. Production will be cut back, freeing up work space. This space can be used to add the rotisserie attachments whether Weaver buys the burners or makes them in-house. At this lower output, Weaver will produce the burners in 32 batches of 1,000 units each. On the basis of financial considerations alone, should Weaver purchase the burners from the outside vendor? Show yourcalculations.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0132109178

14th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav