MetroCinemas owns and operates a nationwide chain of movie theaters. The 500 properties in the chain vary

Question:

MetroCinemas owns and operates a nationwide chain of movie theaters. The 500 properties in the chain vary from low-volume, small-town, single-screen theaters to high-volume, big-city, multiscreen theaters.

The management is considering installing machines that will make popcorn on the premises. These machines would allow the theaters to sell freshly popped popcorn rather than the prepopped, prebagged corn that it currently sells. This proposed feature would be properly advertised and is intended to increase patronage at the company’s theaters.

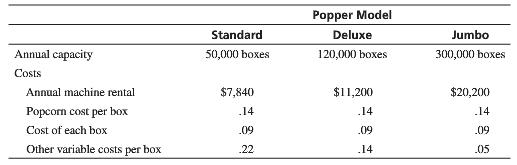

The machines can be purchased in several different sizes. The annual rental costs and operating costs vary with the size of the machines. The machine capacities and costs are as follows:

1. Calculate the volume level in boxes at which the standard and deluxe poppers would earn the same operating profit (loss).

2. The management can estimate the number of boxes to be sold at each of its theaters. Present a decision rule that would enable MetroCinemas management to select the most profitable machine with-out having to make a separate cost calculation for each theater. That is, at what anticipated range of unit sales should the theater use the standard model? The deluxe model? The jumbo model?

3. Could the management use the average number of boxes sold per seat for the entire chain and the capacity of each theater to develop this decision rule? Explain your answer.

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta