Oakdale Fashions, Inc., had $245,000 in 2018 taxable income. Using the tax schedule in Table 2.3, calculate

Question:

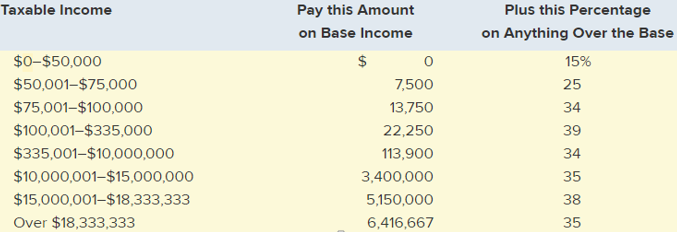

Oakdale Fashions, Inc., had $245,000 in 2018 taxable income. Using the tax schedule in Table 2.3, calculate the company's 2018income taxes. What is the average tax rate? What is the marginal tax rate?

Table 2.3 Corporate Tax Rates as of 2018

Transcribed Image Text:

Plus this Percentage on Anything Over the Base 15% 25 34 39 34 35 Taxable Income Pay this Amount on Base Income $0-$50,000 $50,001-$75,000 7,500 13,750 $75,001-$100,000 22,250 113,900 $100,001-$335,000 $335,001-$10,000,000 $10,000,001-$15,000,000 $15,000,001-$18,333,333 Over $18,333,333 3,400,000 5,150,000 38 35 6,416,667

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

From Table 23 the 245000 of taxable income puts Oakdale F...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Auditing questions

-

Oakdale Fashions, Inc., had $245,000 in 2015 taxable income. Using the tax schedule in Table, calculate the companys 2015 income taxes. What is the average tax rate? What is the marginal tax rate?

-

Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2015. In addition to $42.4 million of taxable income, the firm received $2,975,000 of interest on state-issued bonds and...

-

Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2018. In addition to $42.4 million of taxable income, the firm received $2,975,000 of interest on state-issued bonds and...

-

The data below are the calories and grams of sugar in some popular store bought cookies. Calories 143 Grams of Sugar 12 97 9 200 11 149 19 84 4 57 9 198 21

-

In the Assembly Department of Mantle Company, budgeted and actual manufacturing overhead costs for the month of April 2012 were as follows.. All costs are controllable by the department manager....

-

Juan Kirby is confused about how accounting information flows through the accounting system. He believes the flow of information is as follows. (a) Debits and credits posted to the ledger. (b)...

-

Suppose that a stock will pay a dividend of amount \(D\) at time \(\tau\). We wish to determine the price of a European call option on this stock using the lattice method. Accordingly, the time...

-

The Perfect Crime? Consider the following story of an actual embezzlement. This was the ingenious embezzlers scheme: (a) He hired a print shop to print a private stock of Ajax Company checks in the...

-

Use the given graph off to state the value of the limit, if it exists. 13 y 3 2 14 0 2 4 6 t Qu (a) lim f(x) (b) lim f(x) (b) lim f(x) (c) lim, f(x) (d) lim lim f(x)

-

The file azcounties.dat gives data from the 2000 U.S. Census on population and housing unit counts for the counties in Arizona (excluding Maricopa County and Pima County, which are much larger than...

-

The Fitness Studio, Inc.'s 2018 income statement lists the following income and expenses: EBIT = $773,500, interest expense = $100,000, and taxes = $234,500. The firm has no preferred stock...

-

Ramakrishnan Inc. reported 2018 net income of $15 million and depreciation of $2,650,000. The top part of Ramakrishnan, Inc.'s 2018 and 2017 balance sheets is listed below (in millions of dollars)....

-

During 2014, North Dakota Company issued $1,000,000 in long-term bonds at 96, repaid $150,000 of bonds at face value, paid interest of $80,000, and paid dividends of $50,000. Prepare the cash flows...

-

Each of the following was a year of high unemployment except _____. a) 1933 b) 1938 c) 1944 e) 1982 d) 1975

-

A closed container contains a two-phase (liquidvapor) mixture of water and air. The system temperature is 100C. The mole fraction of water in the vapor is 0.333. Estimate the system pressure. State...

-

Between 1939 and 1944, federal government spending rose by more than _____ . a) 100 percent b) 200 percent c) 300 percent e) 500 percent d) 400 percent

-

The law of increasing costs states that, as ______. a) output rises, cost per unit rises as well b) the output of one good expands, the opportunity cost of producing additional units of this good...

-

Which of these best describes the postWorld War II recessions in the United States? a) They were all very mild, except for the 198182 recession. b) They were all caused by rising interest rates. c)...

-

State three major general characteristics that define a channel.

-

Show that every group G with identity e and such that x * x = e for all x G is abelian.

-

You are considering a stock investment in one of two firms (AllDebt, Inc., and AllEquity, Inc.), both of which operate in the same industry and have identical operating income of $12.5 million....

-

You have been given the following information for Corkys Bedding Corp.: a. Net sales = $11,250,000 b. Cost of goods sold = $7,500,000; c. Other operating expenses = $250,000; d. Addition to retained...

-

You have been given the following information for Corkys Bedding Corp.: a. Net sales = $11,250,000 b. Cost of goods sold = $7,500,000; c. Other operating expenses = $250,000; d. Addition to retained...

-

A couple obtained a $20,000 mortgage loan at an interest rate of 10.5% compounded monthly. (Original principal equals to PV of all payments discounted at the interest rate on the loan contract) (1)...

-

What strategies and tactics are employed to manage strategic risks and uncertainties, including geopolitical instability, supply chain disruptions, and emerging competitive threats, while preserving...

-

How do strategic planners integrate ethical considerations and sustainability imperatives into strategic planning processes, balancing short-term financial objectives with long-term societal and...

Study smarter with the SolutionInn App