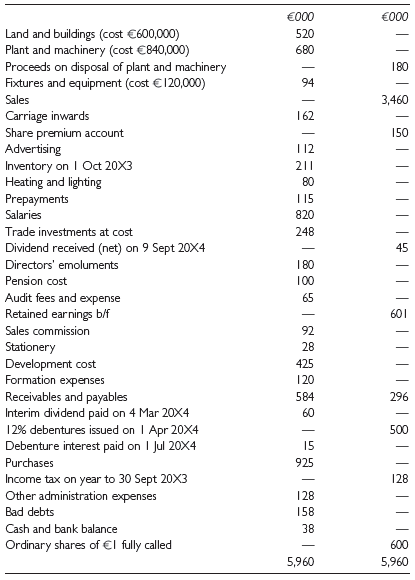

Olive A/S, incorporated with an authorised capital consisting of one million ordinary shares of ¬1 each, employs

Question:

You are informed as follows:

(a) As at 1 October 20X3 land and buildings were revalued at ‚¬900,000. A third of the cost as well as all the valuation is regarded as attributable to the land. Directors have decided to report this asset at valuation.

(b) New fixtures were acquired on 1 January 20X4 for ‚¬40,000; a machine acquired on 1 October 20X1 for ‚¬240,000 was disposed of on 1 July 20X4 for ‚¬180,000, being replaced on the same date by another acquired for ‚¬320,000.

(c) Depreciation for the year is to be calculated on the straight-line basis as follows:

Buildings: 2% p.a.

Plant and machinery: 10% p.a.

Fixtures and equipment: 10% p.a.

(d) Inventor y, including raw materials and work-in-progress on 30 September 20X4, has been valued at cost at ‚¬364,000.

(e) Prepayments are made up as follows:

‚¬000

Amount paid in advance for a machine ......... 60

Amount paid in advance for purchasing raw materials .... 40

Prepaid rent .................... 15

‚¬115

(f) In March 20X3 a customer had filed legal action claiming damages at ‚¬240,000. When accounts for the year ended 30 September 20X3 were finalized, a provision of ‚¬90,000 was made in respect of this claim. This claim was settled out of court in April 20X4 at ‚¬150,000 and the amount of the under-provision adjusted against the profit balance brought forward from previous years.

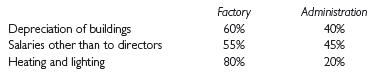

(g) The following allocations have been agreed upon:

(h) Pension cost of the company is calculated at 10% of the emoluments and salaries.

(i) Income tax on 20X3 profit has been agreed at ‚¬140,000 and that for 20X4 estimated at ‚¬185,000. Corporate income tax rate is 35% and the basic rate of personal income tax 25%.

(j) Directors wish to write off the formation expenses as far as possible without reducing the amount of profits available for distribution.

Required:

Prepare for publication:

(a) The Statement of Comprehensive Income of the company for the year ended 30 September 20X4, and

(b) The Statement of Financial Position as at that date along with as many notes (other than the one on accounting policy) as can be provided on the basis of the information madeavailable.

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott