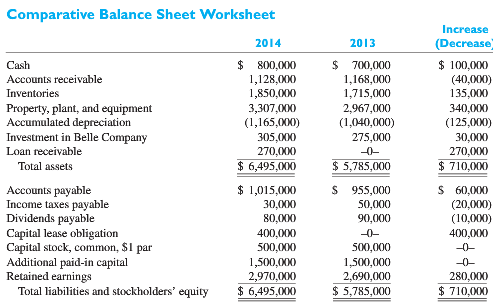

Omega Corporations comparative balance sheet accounts worksheet at December 31, 2014 and 2013, follow, together with a

Question:

Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 2014 and 2013.

Additional Information:

€¢ On January 2, 2014, Bergen sold all of its marketable investment securities for $95,000 cash.

€¢ On March 10, 2014, Bergen paid a cash dividend of $50,000 on its common stock. No other dividends were paid or declared during 2014.

€¢ On April 15, 2014, Bergen issued 2,000 shares of its common stock for land having a fair value of $100,000.

€¢ On May 25, 2014, Bergen borrowed $450,000 from an insurance company. The underlying promissory note bears interest at 15% and is payable in three equal annual installments of $150,000. The first payment is due on May 25, 2015.

€¢ On June 15, 2014, Bergen purchased equipment for $392,000 cash.

€¢ On July 1, 2014, Bergen sold equipment costing $52,000, with a book value of $28,000 for $33,000 cash.

€¢ On December 31, 2014, Bergen leased equipment from Tilden Company for a 10-year period. Equal payments under the lease are $25,000 due on December 31 each year. The first payment was made on December 31, 2014. The present value at December 31, 2014, of the 10 lease payments is $158,000. Bergen appropriately recorded the lease as a capital lease. The $25,000 lease payment due on December 31, 2015, will consist of $9,000 principal and $16,000 interest.

€¢ Bergen's net income for 2014 is $253,000.

€¢ Bergen owns a 10% interest in the voting common stock of Mason, Inc. Mason reported net income of $120,000 for the year ended December 31, 2014, and paid a common stock dividend of $55,000 during 2014.

Required:

Prepare a cash flow statement for Bergen using the indirect method for 2014.

Additional Information:

€¢ On December 31, 2013, Omega acquired 25% of Belle Company's common stock for $275,000. On that date, the carrying value of Belle's assets and liabilities, which approximated their fair values, was $1,100,000. Belle reported income of $120,000 for the year ended December 31, 2014. No dividend was paid on Belle's common stock during the year.

€¢ During 2014, Omega loaned $300,000 to Chase Company, an unrelated company. Chase made the first semiannual principal repayment of $30,000 plus interest at 10%, on October 1, 2014.

€¢ On January 2, 2014, Omega sold equipment for $40,000 cash that cost $60,000 and had a carrying amount of $35,000.

€¢ On December 31, 2014, Omega entered into a capital lease for an office building. The present value of the annual rental payments is $400,000, which equals the building's fair value. Omega made the first rental payment of $60,000, when due, on January 2, 2015.

€¢ Net income for 2014 was $360,000.

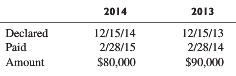

€¢ Omega declared and paid cash dividends for 2014 and 2013 as follows:

Required:

Prepare an indirect method statement of cash flows for Omega Corporation for the year ended December 31, 2014, using the worksheet method illustrated in the appendix to thischapter.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Reporting and Analysis

ISBN: 978-0078025679

6th edition

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon