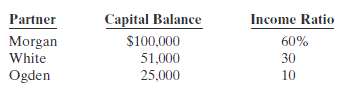

On December 31, the capital balances and income ratios in Noma Company are as follows. Instructions(a) Journalize

Question:

On December 31, the capital balances and income ratios in Noma Company are as follows.

Instructions(a) Journalize the withdrawal of Ogden under each of the following independent assumptions.(1) Each of the remaining partners agrees to pay $15,000 in cash from personal funds to purchase Ogden??s ownership equity. Each receives 50% of Ogden??s equity.(2) White agrees to purchase Ogden??s ownership interest for $22,000 in cash.(3) From partnership assets, Ogden is paid $34,000, which includes a bonus to the retiring partner.(4) Ogden is paid $19,000 from partnership assets. Bonuses to the remaining partners are recognized.(b) If White??s capital balance after Ogden??s withdrawal is $55,000, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership toOgden?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso