On January 1, 2004, Pre Corporation acquired 60 percent of the voting common shares of Sue Corporation

Question:

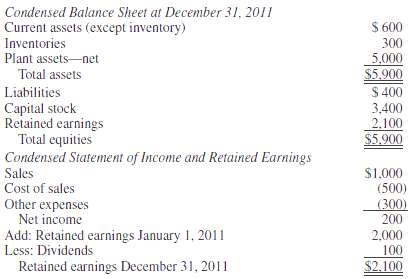

On January 1, 2004, Pre Corporation acquired 60 percent of the voting common shares of Sue Corporation at an excess of fair value over book value of $1,000,000. This excess was attributed to plant assets with a remaining useful life of five years. For the year ended December 31, 2011, Sue prepared condensed financial statements as follows (in thousands):

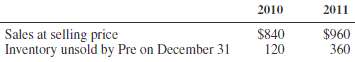

Sue regularly sells inventory items to Pre at a price of 120 percent of cost. In 2010 and 2011, sales from Sue to Pre are as follows:

1. Under the equity method, Pre reports investment income from Sue for 2011 of:a. $120b. $96c. $80d. $104 loss2. Noncontrolling interest on December 31, 2011, is:a. $2,200b. $2,184c. $2,176d. $2,1403. On the books of Pre Corporation, the investment account is properly reflected on December 31, 2011, at:a. $3,240b. $3,264c. $3,276d. Not enough information isgiven.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith