On January 1, 2011, Pod Corporation made the following investments: 1. Acquired for cash, 80 percent of

Question:

On January 1, 2011, Pod Corporation made the following investments:

1. Acquired for cash, 80 percent of the outstanding common stock of Saw Corporation at $140 per share. The stockholders' equity of Saw on January 1, 2011, consisted of the following:

Common stock, par value $100 $100,000

Retained earnings 40,000

2. Acquired for cash, 70 percent of the outstanding common stock of Sun Corporation at $80 per share. The stockholders' equity of Sun on January 1, 2011, consisted of the following:

Common stock, par value $40 $120,000

Capital in excess of par value 40,000

Retained earnings 80,000

3. After these investments were made, Pod was able to exercise control over the operations of both companies.

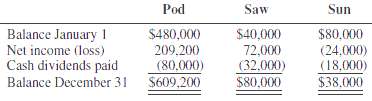

An analysis of the retained earnings of each company for 2011 is as follows:

REQUIRED

1. What entries should have been made on the books of Pod during 2011 to record the following?

a. Investments in subsidiaries

b. Subsidiary dividends received

c. Parent's share of subsidiary income or loss

2. Compute the amount of noncontrolling interest in each subsidiary's stockholders' equity at December 31, 2011.

3. What amount should be reported as consolidated retained earnings of Pod Corporation and subsidiaries as of December 31, 2011?

4. Compute the correct balances of Pod's Investment in Saw and Investment in Sun accounts at December 31, 2011, beforeconsolidation.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith