On January 1, 2013, Seaside Enterprises issued bonds with a face value of $60,000, a stated rate

Question:

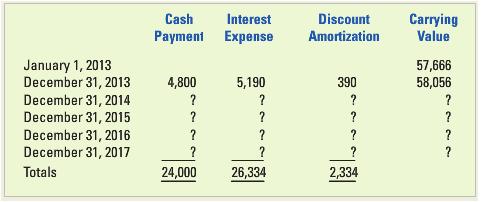

On January 1, 2013, Seaside Enterprises issued bonds with a face value of $60,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $57,666. Seaside used the effective interest rate method to amortize bond discount.

Required

a. Prepare an amortization table as shown below:

b. What item(s) in the table would appear on the 2014 balance sheet?

c. What item(s) in the table would appear on the 2014 income statement?

d. What item(s) in the table would appear on the 2014 statement of cash flows?

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Fundamental financial accounting concepts

ISBN: 978-0078025365

8th edition

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward