On January 2, 2011, Par Corporation issues its own $10 par common stock for all the outstanding

Question:

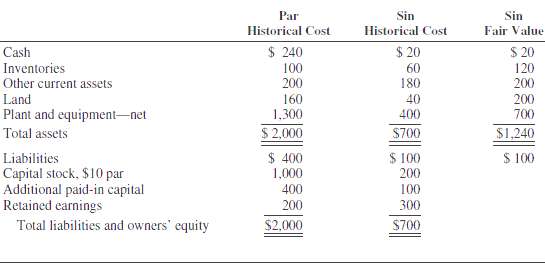

On January 2, 2011, Par Corporation issues its own $10 par common stock for all the outstanding stock of Sin Corporation in an acquisition. Sin is dissolved. In addition, Par pays $40,000 for registering and issuing securities and $60,000 for other costs of combination. The market price of Par's stock on January 2, 2011, is $60 per share. Relevant balance sheet information for Par and Sin Corporations on December 31, 2010, just before the combination, is as follows (in thousands):

1. Assume that Par issues 25,000 shares of its stock for all of Sin's outstanding shares.a. Prepare journal entries to record the acquisition of Sin.b. Prepare a balance sheet for Par Corporation immediately after the acquisition.2. Assume that Par issues 15,000 shares of its stock for all of Sin's outstanding shares.a. Prepare journal entries to record the acquisition of Sin.b. Prepare a balance sheet for Par Corporation immediately after theacquisition.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith