Pam Corporation owns two-thirds (600,000 shares) of the outstanding $1 par common stock of Sat Company on

Question:

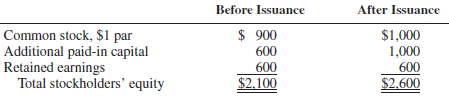

Pam Corporation owns two-thirds (600,000 shares) of the outstanding $1 par common stock of Sat Company on January 1, 2011. In order to raise cash to finance an expansion program, Sat issues an additional 100,000 shares of its common stock for $5 per share on January 3, 2011. Sat’s stockholders’ equity before and after the new stock issuance is as follows (in thousands):

REQUIRED

1. Assume that Pam purchases all 100,000 shares of common stock directly from Sat.

a. What is Pam’s percentage ownership interest in Sat after the purchase?

b. Calculate goodwill from Pam’s acquisition of the 100,000 shares of Sat.

2. Assume that the 100,000 shares of common stock are sold to Van Company, one of Sat’s noncontrolling stockholders.

a. What is Pam’s percentage ownership interest after the new shares are sold to Van?

b. Calculate the change in underlying book value of Pam’s investment after the sale.

c. Prepare the journal entry on Pam’s books to recognize the increase or decrease in underlying book value computed in b above assuming that gain or loss is not recognized.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith