Par Corporation acquired a 70 percent interest in Sul Corporation's outstanding voting common stock on January 1,

Question:

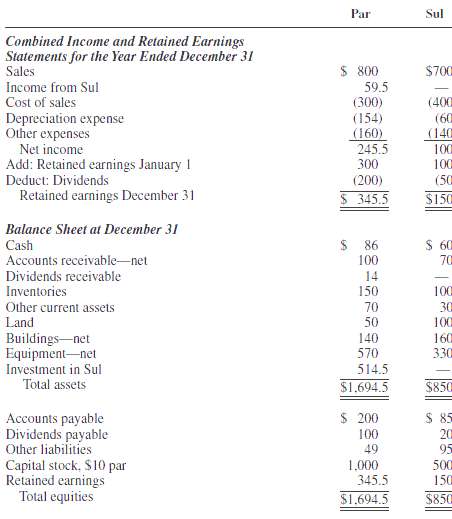

Par Corporation acquired a 70 percent interest in Sul Corporation's outstanding voting common stock on January 1, 2011, for $490,000 cash. The stockholders' equity (book value) of Sul on this date consisted of $500,000 capital stock and $100,000 retained earnings. The differences between the fair value of Sul and the book value of Sul were assigned $5,000 to Sul's undervalued inventory, $14,000 to undervalued buildings, $21,000 to undervalued equipment, and $40,000 to previously unrecorded patents. Any remaining excess is goodwill. The undervalued inventory items were sold during 2011, and the undervalued buildings and equipment had remaining useful lives of seven years and three years, respectively. The patents have a 40-year life. Depreciation is straight line. At December 31, 2011, Sul's accounts payable include $10,000 owed to Par. This $10,000 account payable is due on January 15, 2012. Separate financial statements for Par and Sul for 2011 are summarized as follows (in thousands):

REQUIRED: Prepare consolidation workpapers for Par Corporation and Subsidiary for the year ended December 31, 2011. Use an unamortized excessaccount.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith