Par Corporation acquired a 90 percent interest in Sag Corporation's outstanding voting common stock on January 1,

Question:

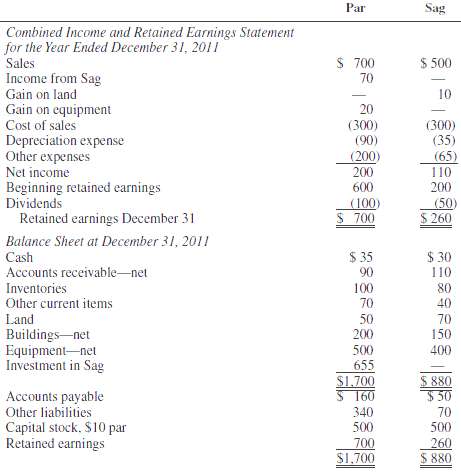

Par Corporation acquired a 90 percent interest in Sag Corporation's outstanding voting common stock on January 1, 2011, for $630,000 cash. The stockholders' equity of Sag on this date consisted of $500,000 capital stock and $200,000 retained earnings. The financial statements of Par and Sag at and for the year ended December 31, 2011, are summarized as follows (in thousands):

During 2011, Par made sales of $50,000 to Sag at a gross profit of $15,000. One-third of these sales were inventoried by Sag at year-end. Sag owed Par $10,000 on open account at December 31, 2011. Sag sold land that cost $20,000 to Par for $30,000 on July 1, 2011. Par still owns the land. On January 1, 2011, Par sold equipment with a book value of $20,000 and a remaining useful life of four years to Sag for $40,000. Sag uses straight-line depreciation and assumes no salvage value on this equipment.REQUIRED: Prepare a consolidation workpaper for Par and Subsidiary for the year ended December 31,2011.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith