Par Corporation acquires an 80 percent interest in Sip Company on January 3, 2011, for $320,000. On

Question:

Par Corporation acquires an 80 percent interest in Sip Company on January 3, 2011, for $320,000. On this date Sip's stockholders' equity consists of $200,000 capital stock and $140,000 retained earnings. The fair value/book value differential is assigned to undervalued equipment with a 6-year remaining life. Immediately after acquisition, Sip sells equipment with a 10-year remaining useful life to Par at a gain of $10,000.

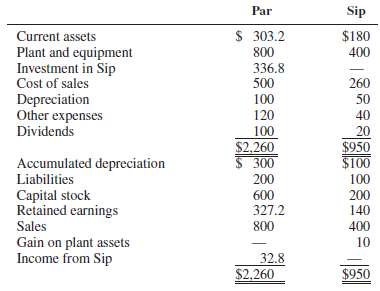

Adjusted trial balances of Par and Sip at December 31, 2011, are as follows (in thousands):

REQUIRED1. Prepare a consolidated income statement for 2011 using entity theory.2. Prepare a consolidated balance sheet at December 31, 2011, using entitytheory.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith