Pat Company paid $1,800,000 for 90,000 shares of Sir Company's 100,000 outstanding shares on January 1, 2011,

Question:

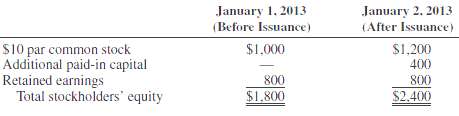

Pat Company paid $1,800,000 for 90,000 shares of Sir Company's 100,000 outstanding shares on January 1, 2011, when Sir's equity consisted of $1,000,000 of $10 par common stock and $500,000 retained earnings. The excess fair value over book value was goodwill. On January 2, 2013, Sir sold an additional 20,000 shares to the public for $600,000, and its equity before and after issuance of the additional 20,000 shares was as follows (in thousands):

REQUIRED

1. Determine Pat's Investment in Sir account balance on January 1, 2013.

2. Prepare the entry on Pat's books to account for its decreased ownership interest if gain or loss is notrecognized.

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith