Paul Ward is interested in the stock of Pecunious Products, Inc. Before purchasing the stock, Ward would

Question:

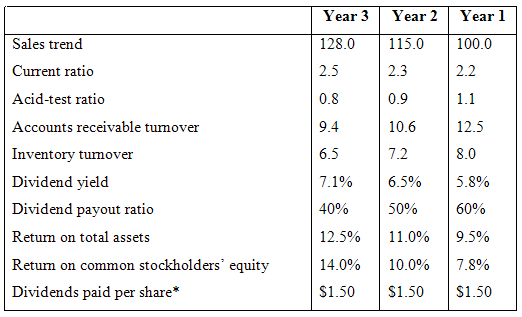

Paul Ward is interested in the stock of Pecunious Products, Inc. Before purchasing the stock, Ward would like your help in analyzing the data that are available to him as follows: Mr. Ward would like answers to a number of questions about the trend of events in Pecunious Products, Inc., over the last three years. His questions are:

1) Is it becoming easier for the company to pay its bills as they come due?

2) Are customers paying their accounts at least as fast now as they were in Year 1?

3) Is the total of the accounts receivable increasing, decreasing, or remaining constant?

4) Is the level of inventory increasing, decreasing, or remaining constant?

5) Is the market price of the company’s stock going up or down?

6) Is the earnings per share increasing or decreasing?

7) Is the price-earning ratio going up or down?

8) Is the company employing financial leverage to the advantage of the common stockholders?

Required:

Answer each of Mr. Ward’s questions and explain how you arrived at your answers.

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer