Paw Corporation paid $180,000 cash for a 90 percent interest in Sun Corporation on January 1, 2012,

Question:

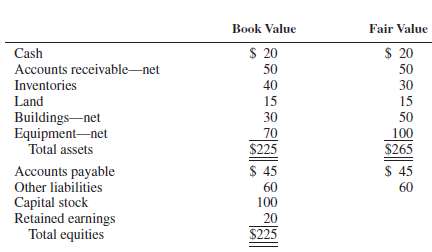

Paw Corporation paid $180,000 cash for a 90 percent interest in Sun Corporation on January 1, 2012, when Sun's stockholders' equity consisted of $100,000 capital stock and $20,000 retained earnings. Sun Corporation's balance sheets at book value and fair value on December 31, 2011, are as follows (in thousands):

ADDITIONAL INFORMATION1. The amortization periods for the fair value/book value differentials at the time of acquisition are as follows:Overvalued inventories (sold in 2012) ...... $10,000Undervalued buildings (10-year useful lives) .... 20,000Undervalued equipment (5-year useful lives) .... 30,000Goodwill ................. Remainder2. Paw uses the equity method to account for its interest in Sun.REQUIRED1. Prepare a journal entry on Sun Corporation's books to push down the values reflected in the purchase price under parent-company theory.2. Prepare a journal entry on Sun Corporation's books to push down the values reflected in the purchase price under entity theory.3. Prepare comparative balance sheets for Sun Corporation on January 1, 2012, under the approaches of (1) and(2).

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith