Peg Corporation owns 90 percent of the voting stock of Sup Corporation and 25 percent of the

Question:

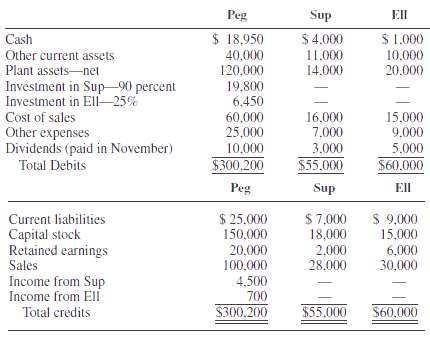

Peg Corporation owns 90 percent of the voting stock of Sup Corporation and 25 percent of the voting stock of Ell Corporation. The 90 percent interest in Sup was acquired for $18,000 cash on January 1, 2011, when Sup's stockholders' equity was $20,000 ($18,000 capital stock and $2,000 retained earnings). Peg's 25 percent interest in Ell was purchased for $7,000 cash on July 1, 2011, when Ell's stockholders' equity was $24,000 ($15,000 capital stock, $6,000 retained earnings, and $3,000 current earnings'first half of 2010). The difference between fair value and book value is due to unrecorded patents and is amortized over 10 years. Adjusted trial balances of the three associated companies at December 31, 2011, are as follows:

REQUIRED1. Reconstruct the journal entries that were made by Peg Corporation during 2011 to account for its investments in Sup and Ell Corporations.2. Prepare an income statement, a retained earnings statement, and a balance sheet for Peg Corporation for December 31, 2011.3. Prepare consolidation workpapers (trial balance format) for Peg and Subsidiaries for 2011.4. Prepare consolidated financial statements other than the cash flows statement for Peg Corporation and Subsidiaries for the year ended December 31,2011.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith