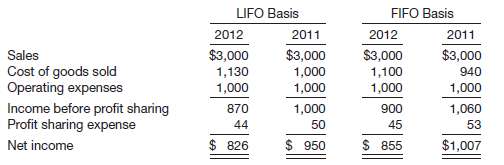

Presented on page 1410 are income statements prepared on a LIFO and FIFO basis for Carlton Company,

Question:

Presented on page 1410 are income statements prepared on a LIFO and FIFO basis for Carlton Company, which started operations on January 1, 2011. The company presently uses the LIFO method of pricing its inventory and has decided to switch to the FIFO method in 2012. The FIFO income statement is computed in accordance with GAAP requirements. Carlton?s profit-sharing agreement with its employees indicates that the company will pay employees 5% of income before profit sharing. Income taxes are ignored.

InstructionsAnswer the following questions.(a) If comparative income statements are prepared, what net income should Carlton report in 2011 and 2012?(b) Explain why, under the FIFO basis, Carlton reports $50 in 2011 and $48 in 2012 for its profit-sharing expense.(c) Assume that Carlton has a beginning balance of retained earnings at January 1, 2012, of $8,000 using the LIFO method. The company declared and paid dividends of $2,500 in 2012. Prepare the retained earnings statement for 2012, assuming that Carlton has switched to the FIFO method.

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer: