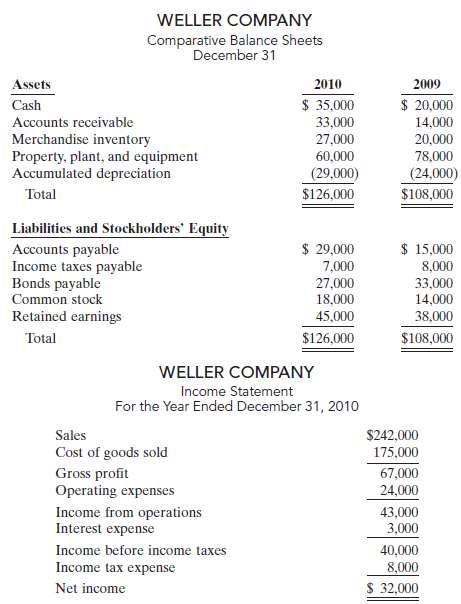

Presented on the next page are the financial statements of Weller Company. Additional data:1. Dividends declared and

Question:

Presented on the next page are the financial statements of Weller Company.

Additional data:1. Dividends declared and paid were $25,000.2. During the year equipment was sold for $8,500 cash. This equipment cost $18,000 originally and had a book value of $8,500 at the time of sale.3. All depreciation expense, $14,500, is in the operating expenses.4. All sales and purchases are on account.Instructions(a) Prepare a statement of cash flows using the indirect method.(b) Compute free cashflow.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted: