PWA Corporation paid $1,710,000 for 100 percent of the stock of SAA Corporation on January 1, 2011,

Question:

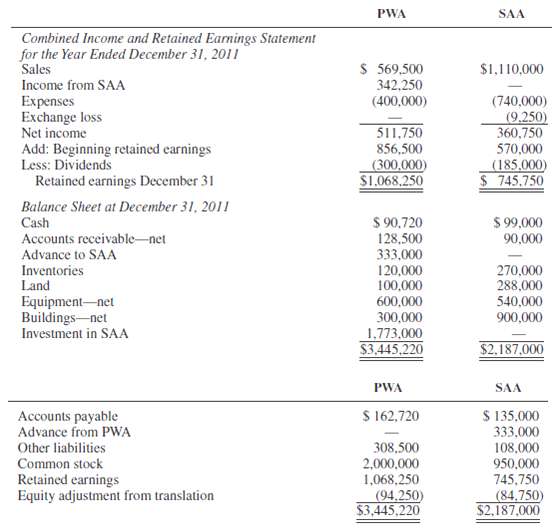

PWA Corporation paid $1,710,000 for 100 percent of the stock of SAA Corporation on January 1, 2011, when the stockholders' equity of SAA consisted of 5,000,000 LCU capital stock and 3,000,000 LCU retained earnings. SAA's functional currency is the local currency unit, and any cost/book value differential is attributable to a patent with a 10-year amortization period.

On July 1, 2011, PWA advanced $333,000 (1,800,000 LCU) to SAA when the exchange rate was $0.185. The advance is short-term and denominated in U.S. dollars.

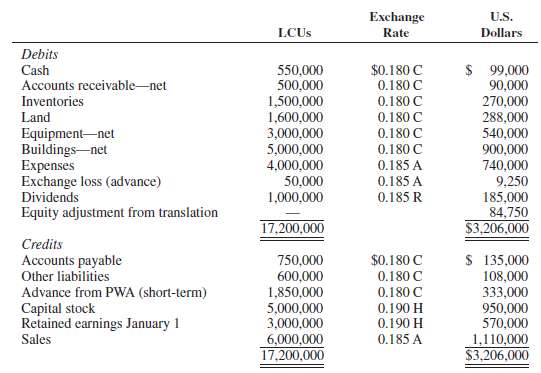

Relevant exchange rates for LCUs for 2011 are as follows:

Rate at acquisition on January 1 ........ $0.190

Rate applicable to the advance on July 1 ..... 0.185

Rate applicable to dividends on September 1 ... 0.185

Average rate for the year .......... 0.185

Current rate at December 31 ......... 0.180

A translation worksheet for SAA's adjusted trial balance at December 31, 2011, is as follows:

Financial statements for PWA and SAA at and for the year ended December 31, 2011, are summarized as follows:

REQUIRED1. Prepare journal entries on PWA's books to account for its investment in SAA for 2011.2. Prepare consolidation working papers for PWA Corporation and Subsidiary for the year ended December 31,2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith