Quality improvement, relevant costs, relevant revenues. SpeedPrint manufactures and sells 18,000 high-technology printing presses each year. The

Question:

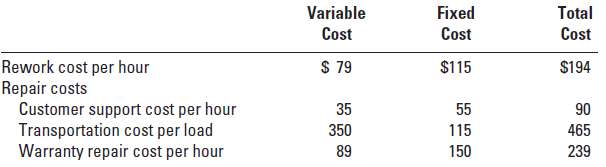

Quality improvement, relevant costs, relevant revenues. SpeedPrint manufactures and sells 18,000 high-technology printing presses each year. The variable and fixed costs of rework and repair are as follows:

SpeedPrint's current presses have a quality problem that causes variations in the shade of some colors. Its engineers suggest changing a key component in each press. The new component will cost $70 more than the old one. In the next year, however, SpeedPrint expects that with the new component it will (1) save 14,000 hours of rework, (2) save 850 hours of customer support, (3) move 225 fewer loads, (4) save 8,000 hours of warranty repairs, and (5) sell an additional 140 printing presses, for a total contribution margin of $1,680,000. SpeedPrint believes that even as it improves quality, it will not be able to save any of the fixed costs of rework or repair. SpeedPrint uses a one-year time horizon for this decision because it plans to introduce a new press at the end of the year.Required1. Should SpeedPrint change to the new component? Show your calculations.2. Suppose the estimate of 140 additional printing presses sold is uncertain. What is the minimum number of additional printing presses that SpeedPrint needs to sell to justify adopting the newcomponent?

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0132109178

14th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav