Recognition of Profit and Entries on Long-Term Contract On March 1, 2010, Chance Company entered into a

Question:

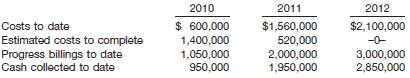

Recognition of Profit and Entries on Long-Term Contract On March 1, 2010, Chance Company entered into a contract to build an apartment building. It is estimated that the building will cost $2,000,000 and will take 3 years to complete. The contract price was $3,000,000. The following information pertains to the construction period.

Instructions

(a) Compute the amount of gross profit to be recognized each year assuming the percentage-of completion method is used.

(b) Prepare all necessary journal entries for 2012.

(c) Prepare a partial balance sheet for December 31, 2011, showing the balances in the receivables and inventoryaccounts.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield