Recognition of Profit on Long-Term Contract Shanahan Construction Company has entered into a contract beginning January 1,

Question:

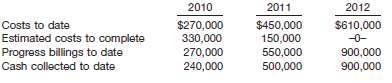

Recognition of Profit on Long-Term Contract Shanahan Construction Company has entered into a contract beginning January 1, 2010, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $900,000. The following data pertain to the construction period.

Instructions

(a) Using the percentage-of-completion method, compute the estimated gross profit that would be recognized during each year of the construction period.

(b) Using the completed-contract method, compute the estimated gross profit that would be recognized during each year of the construction period.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield