Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4 and your

Question:

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4 and your calculations in Short Exercises S26- 5 and S26- 6. Assume the expansion has zero residual value.

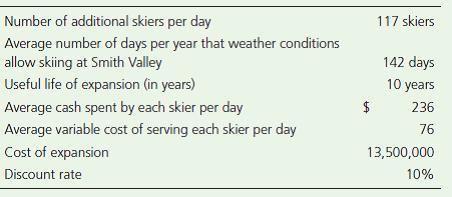

Data from Exercise S26-4

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Requirements

1. Will the payback change? Explain your answer. Recalculate the payback if it changes. Round to one decimal place.

2. Will the project’s ARR change? Explain your answer. Recalculate ARR if it changes. Round to two decimal places.

3. Assume Smith Valley screens its potential capital investments using the following decision criteria:

Maximum payback period ........................... 5.3 years

Minimum accounting rate of return .......... 16.55%

Will Smith Valley consider this project further or reject it?

Payback PeriodPayback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura