Relative Sales Value Method Larsen Realty Corporation purchased a tract of unimproved land for $55,000. This land

Question:

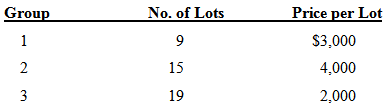

Relative Sales Value Method Larsen Realty Corporation purchased a tract of unimproved land for $55,000. This land was improved and subdivided into building lots at an additional cost of $30,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows.

Operating expenses for the year allocated to this project total $18,200. Lots unsold at the year-end were as follows.

Group 1..............................5 lots

Group 2..............................7 lots

Group 3..............................2 lots

At the end of the fiscal year Larsen Realty Corporation instructs you to arrive at the net income realized on this operation to date.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield