Relevant costs, sunk costs, product replacement decisions Syd Young, the production manager at Fuchow Company, purchased a

Question:

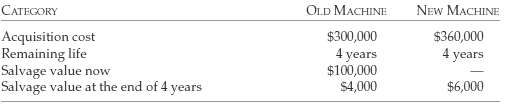

Relevant costs, sunk costs, product replacement decisions Syd Young, the production manager at Fuchow Company, purchased a cutting machine for the company last year. Six months after the purchase of the cutting machine, Syd learned about a new cutting machine that is more reliable than the machine that he purchased. The following information is available for the two machines:

Annual operating costs for the old machine are $140,000. The new machine will decrease annual operating costs by $60,000. These amounts do not include any charges for depreciation. Fuchow Company uses the straight-line depreciation method. These estimates of operating costs exclude rework costs. The new machine will also result in a reduction in the defect rate from the current 5% to 2.5%. All defective units are reworked at a cost of $1 per unit. The company, on average, produces 100,000 units annually.(a) Should Syd Young replace the old machine with the new machine? Explain, listing all relevant costs.(b) What costs should be considered as sunk costs for this decision?(c) What other factors may affect Young's decision?

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young