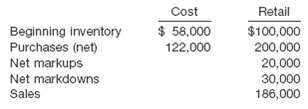

Retail Inventory Method Presented below is information related to McKenna Company. (a) Compute the ending inventory at

Question:

Retail Inventory Method Presented below is information related to McKenna Company.

(a) Compute the ending inventory at retail.

(b) Compute a cost-to-retail percentage (round to two decimals) under the following conditions.

(1) Excluding both markups and markdowns.

(2) Excluding markups but including markdowns.

(3) Excluding markdowns but including markups.

(4) Including both markdowns and markups.

(c) Which of the methods in (b) above (1, 2, 3, or 4) does the following?

(1) Provides the most conservative estimate of ending inventory.

(2) Provides an approximation of lower-of-cost-or-market.

(3) Is used in the conventional retail method.

(d) Compute ending inventory at lower-of-cost-or-market (round to nearest dollar).

(e) Compute cost of goods sold based on (d).

(f) Compute gross margin based on(d).

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield