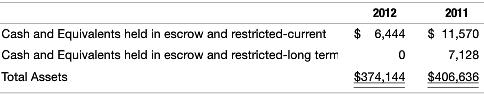

Safeguard Scientifics Inc. reported the following in its 2012 financial statements (amounts in thousands) In March 2010,

Question:

Safeguard Scientifics Inc. reported the following in its 2012 financial statements (amounts in thousands)

In March 2010, the Company issued an aggregate of $46.9 million in face value of convertible senior debentures (bonds) with a stated maturity of March 15, 2014 (the €œ2014 Debentures€). At the time of issuance, as required under the terms of the 2014 Debentures, the Company placed approximately $19.0 million in a restricted escrow account to make all scheduled interest payments on the 2014 Debentures through their maturity. During 2012 and 2011, interest payments of $4.8 million and $4.8 million, respectively, were made out of the restricted escrow account and are considered non-cash activities. Upon repurchase of the 2014 Debentures, $7.7 million was released from the restricted escrow account representing interest payments that would have been due through maturity of the 2014 Debentures.

REQUIRED:

a. Why would a potential investor or creditor want to know about restrictions on Cash?

b. What is the difference between Restricted Cash that is considered current and Restricted Cash that is considered Long-Term?

c. How might the disclosures on Restricted Cash affect the calculation of working capital, the current ratio, and the quick ratio?

d. If Safeguard Scientifics had not retired its Debentures prior to maturity, what would have been the effect on the 2012 Cash balances (both restricted andunrestricted)?

Debenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer: