Saxon Products, Inc., is investigating the purchase of a robot for use on the companys assembly line.

Question:

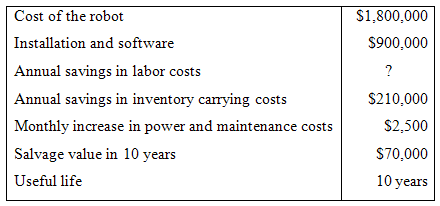

Saxon Products, Inc., is investigating the purchase of a robot for use on the company’s assembly line. Selected data relating to the robot are provided below:

Engineering studies suggest that use of the robot will result in a savings of 25,000 direct labor- hours each year. The labor rate is $16 per hour. Also, the smoother work flow made possible by the use of automation will allow the company to reduce the amount of inventory on hand by $400,000. This inventory reduction will take place at the end of the first year of operation; the released funds will be available for use elsewhere in the company. Saxon Products has a 20% required rate of return.

Shelly Martins, the controller, has noted that all of Saxon’s competitors are automating their plants. She is pessimistic, however, about whether Saxon’s management will allow it to automate. In preparing the proposal for the robot, she stated to a colleague, “Let’s just hope that reduced labor and inventory costs can justify the purchase of this automated equipment. Otherwise, we’ll never get it. You know how the president feels about equipment paying for itself out of reduced costs.”

Required:

(Ignore income taxes.)

1. Determine the annual net cost savings if the robot is purchased. (Do not include the $400,000 inventory reduction or the salvage value in this computation.)

2. Compute the net present value of the proposed investment in the robot. Based on these data, would you recommend that the robot be purchased? Explain.

3. Assume that the robot is purchased. At the end of the first year, Shelly Martins has found that some items didn’t work out as planned. Due to unforeseen problems, software and installation costs were $75,000 more than estimated and direct labor has been reduced by only 22,500 hours per year, rather than by 25,000 hours. Assuming that all other cost data were accurate, does it appear that the company made a wise investment? Show computations using the net present value format as in (2) above. (Hint: It might be helpful to place yourself back at the beginning of the first year with the new data.)

4. Upon seeing your analysis in (3) above, Saxon’s president stated, “That robot is the worst investment we’ve ever made. And now we’ll be stuck with it for years.”

(a) Explain to the president what benefits other than cost savings might accrue from using the new automated equipment.

(b) Compute for the president the dollar amount of cash inflow that would be needed each year from the benefits in (a) above for the automated equipment to yield a 20% rate of return.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer