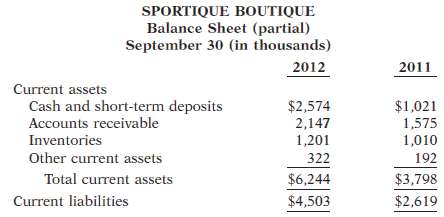

Sportique Boutique reported the following financial data for 2012 and 2011. Instructions(a) Calculate the current ratio for

Question:

Sportique Boutique reported the following financial data for 2012 and 2011.

Instructions(a) Calculate the current ratio for Sportique Boutique for 2012 and 2011.(b) Suppose that at the end of 2012, Sportique Boutique used $1.5 million cash to pay off $1.5 million of accounts payable. How would its current ratio change?(c) At September 30, Sportique Boutique has an undrawn operating line of credit of $12.5 million. Would this affect any assessment that you might make of Sportique Boutique??s short-term liquidity?Explain.

Line of CreditA line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: