George Parker was paid a salary of $74,700 during 20-- by Umberger Company. In addition, during the

Question:

Transcribed Image Text:

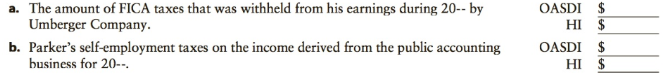

The amount of FICA taxes that was withheld from his earnings during 20-- by OASDI $ Umberger Company. HI $ b. Parker's self-employment taxes on the income derived from the public accounting business for 20-. OASDI $ HI $

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

a The amount of FICA taxes that was withheld from OASDI 463140 his earnings during 20by ...View the full answer

Answered By

Antony Mutonga

I am a professional educator and writer with exceptional skills in assisting bloggers and other specializations that necessitate a fantastic writer. One of the most significant parts of being the best is that I have provided excellent service to a large number of clients. With my exceptional abilities, I have amassed a large number of references, allowing me to continue working as a respected and admired writer. As a skilled content writer, I am also a reputable IT writer with the necessary talents to turn papers into exceptional results.

4.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

George Parker was paid a salary of $74,700 during 2013 by Umberger Company. In addition, during the year, Parker started his own business as a public accountant and reported a net business income of...

-

A consultant is paid a salary of 40,000 per annum and her employer pays national insurance of 12% and pension contributions of 6%. Assuming the consultants works 230 days per year and is productive...

-

Mr. David started his own business on 1 November 2019. The following is the list of his transactions in that month: Nov 2019 Transactions 1 Start his business by investing RM3,500 of his own money...

-

In Exercises 8586, find a. (f g)(x); b. (g f)(x); c. (f g)(3). f(x) = x 2 + 3, g(x) = 4x - 1

-

Payscale.com tracks the graduates of all institutions of higher education and determines the return on investment (ROI) of the school's graduates. ROI can be thought of as the investment return on...

-

If Congress wants to stimulate the economy, explain how it might alter each of the following: (a) Personal and corporate tax rates, (b) Depreciation schedules, (c) The differential between the tax...

-

What issues might arise during and as a result of the implementation of HRIS T&D applications?

-

You are the manager of 3D Designsa large imaging company that does graphics and Web design work for companies. You and your only competitor are contemplating the purchase of a new 3-D imaging device....

-

What role do ethical considerations play in crisis management decision-making processes, particularly concerning stakeholder prioritization and resource allocation during tumultuous circumstances ?

-

The following exercise is based on a series of investments made in 1993 by City Colleges of Chicago (CCC), a system of community colleges. Its treasurer decided to invest up to 70% of its portfolio...

-

Ernie Gilmore began working as a part-time waiter on June 1, 2017, at Sporthouse Restaurant. The cash tips of $390 that he received during June were reported on Form 4070, which he submitted to his...

-

Breathing Oxygen. The density of air under standard laboratory conditions 1.29 kg/m 3 is and about 20% of that air consists of oxygen. Typically, people breathe about L of air per breath. (a) How...

-

Probability Sampling. Four methods include: Simple random, Systematic, Stratified, and Cluster Sampling. When would a particular method(s) be used? All respondents are known. (a) The respondents are...

-

Describe the most significant challenge(s) that the organization may face in the next five years. Explain with your own nearest building in process.

-

What payroll related tax is based on wages paid to employees and based on employer's payment history? Also explain federal income tax, unemployment taxes, Social Security taxes and income tax.

-

What are the two best practices related to Single Touch Payroll and 2 which relate to BAS preparation or lodgment, which ensure compliance with legislative requirements.

-

Accounting for environmental factors, list 4 different type of wastes that may be present in your aged care residential? Include in your answer how you would dispose of the different types of waste...

-

Establish procedures for HACCP verification and validation for strawberry and peanut butter uncrustables . Discuss record keeping procedures of strawberry and peanut butter uncrustables.

-

The short-term (no more than 24 hours) parking fee F (in dollars) for parking x hours at OHare International Airports main parking garage can be modeled by the function Determine the fee for parking...

-

In Problem use absolute value on a graphing calculator to find the area between the curve and the x axis over the given interval. Find answers to two decimal places. y = x 3 ln x; 0.1 x 3.1

-

To what extent are tips considered wages under the FLSA?

-

Explain how a state employee working in the area of public safety may use compensatory time off in lieu of overtime compensation.

-

Under what conditions would an employee of a state receive cash for his or her compensatory time off?

-

Non-liquidating distributions can be dividends, return of capital, or capital gain income to a shareholder. What type of distribution would be capital gain?

-

TranscribedText: Req A1 Req A2 Req C1 Req C2 Req D1 Req D2 Complete the table under the current cost system. (Round your intermediate calculations and final answers to 2 decimal places. Negative...

-

Anton's Fresh Fish and Produce is a wholesale distributor that operates in central Florida. An analysis of two of the company's customers, Seaside Spa and Sigma Assisted Living, reveals the data that...

Study smarter with the SolutionInn App