Question:

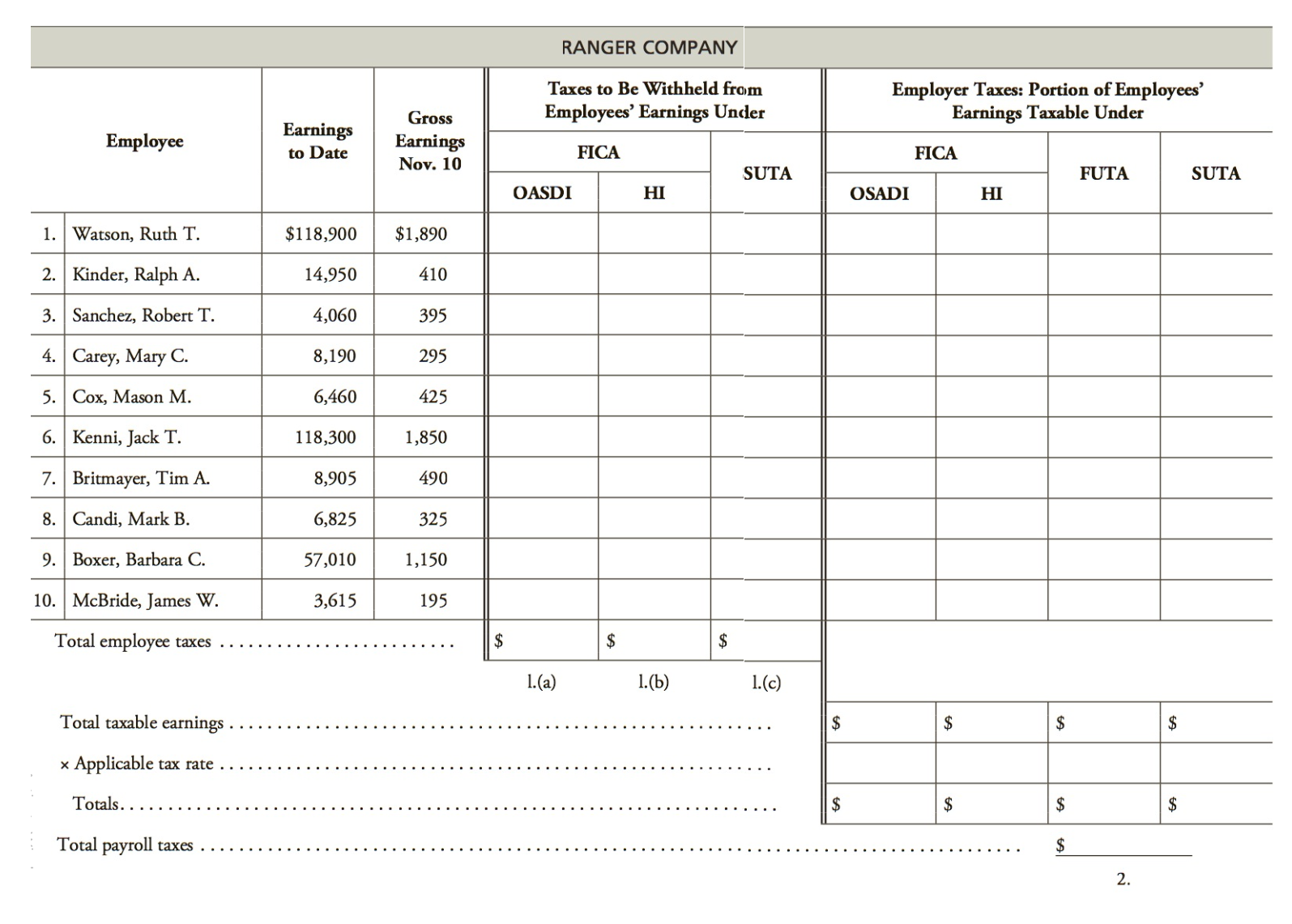

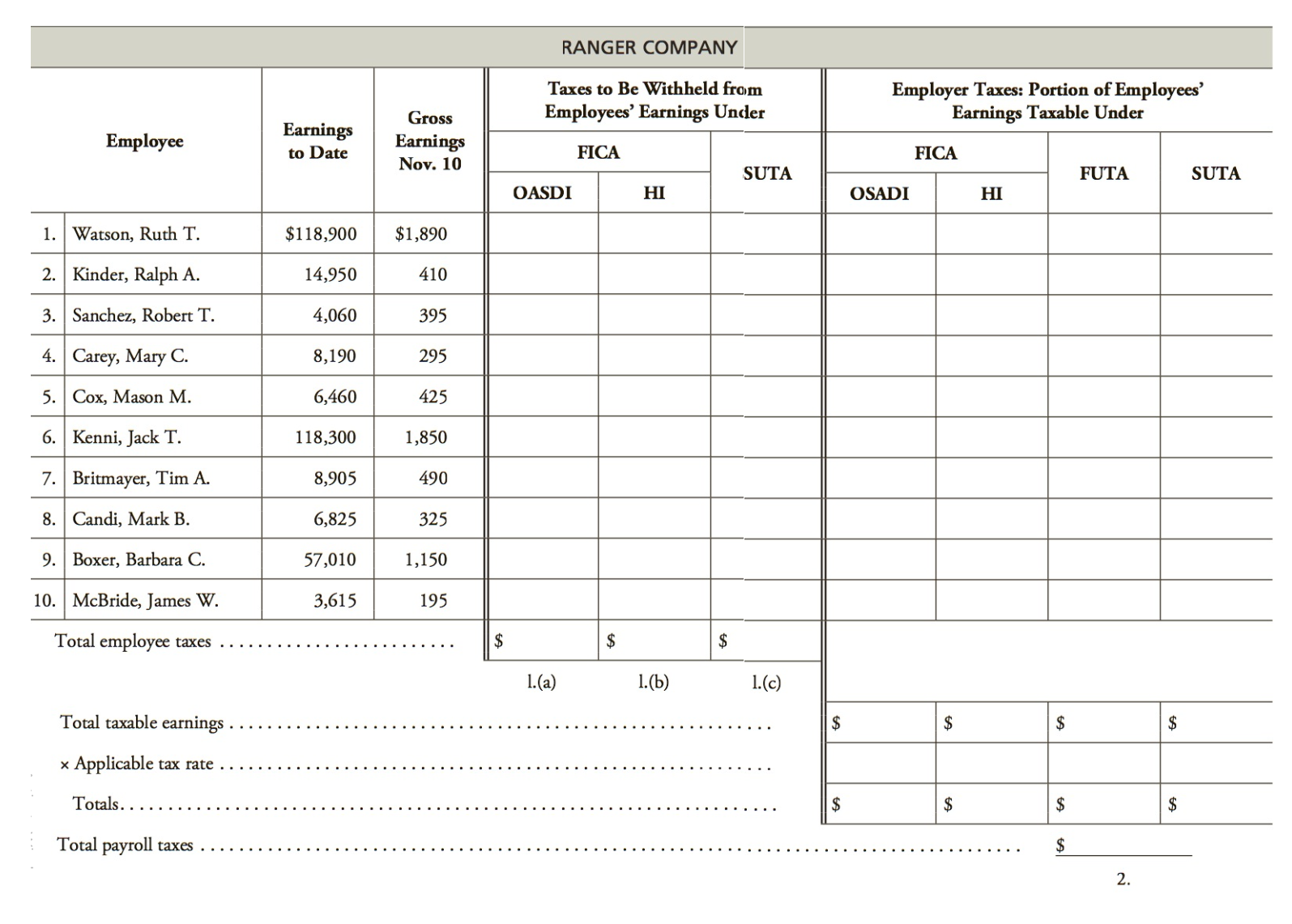

The form on page 6-69 shows the amounts that appear in the Earnings to Date column of the employees€™ earnings records for 10 full-time and part-time workers in Ranger Company. These amounts represent the cumulative earnings for each worker as of November 3, the company€™s last payday. The form also gives the gross amount of earnings to be paid each worker on the next payday, November 10.

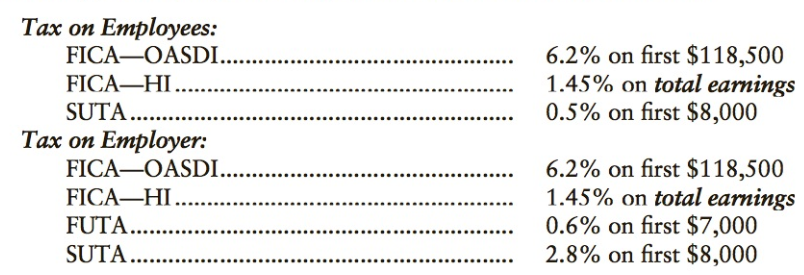

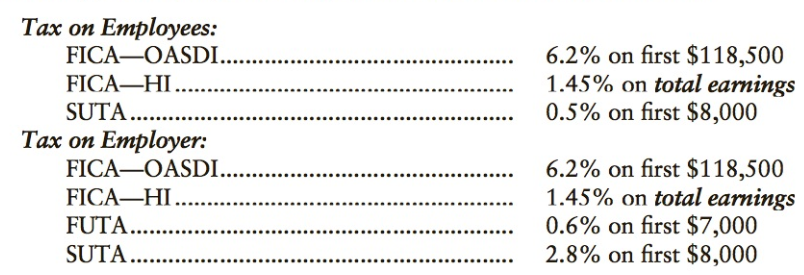

In the state where Ranger Company is located, the tax rates and bases are as follows:

In the appropriate columns of the form on page 6-69, do the following:

1. Compute the amount to be withheld from each employee€™s earnings on November 10 for (a) FICA€”OASDI, (b) FICA€”HI, and (c) SUTA, and determine the total employee taxes.

2. Record the portion of each employee€™s earnings that is taxable under FICA, FUTA, and SUTA, and calculate the total employer€™s payroll taxes on the November 10 payroll.

Transcribed Image Text:

Tax on Employees: FICA-OASD.... FICA–HI... SUTA.. . Tax on Employer: FICA-OASDI. FICA–HI... FUTA... SUTA... 6.2% on first $118,500 1.45% on total earnings 0.5% on first $8,000 6.2% on first $118,500 1.45% on total earnings 0.6% on first $7,000 2.8% on first $8,000 RANGER COMPANY Taxes to Be Withheld from Employer Taxes: Portion of Employees' Earnings Taxable Under Gross Employees' Earnings Under Earnings Employee Earnings to Date FICA FICA Nov. 10 SUTA FUTA SUTA OASDI HI OSADI HI 1. Watson, Ruth T. $118,900 $1,890 2. Kinder, Ralph A. 14,950 410 3. Sanchez, Robert T. 4,060 395 4. Carey, Mary C. 8,190 295 5. Cox, Mason M. 6,460 425 6. Kenni, Jack T. 118,300 1,850 7. Britmayer, Tim A. 8,905 490 8. Candi, Mark B. 6,825 325 9. Boxer, Barbara C. 57,010 1,150 10. McBride, James W. 3,615 195 Total employee taxes 1.(a) 1.(b) 1.(c) Total taxable earnings x Applicable tax rate Totals... Total payroll taxes 2$ 2.