Ishaka and Joshua are in partnership, sharing profits and losses as follows: Ishaka 60 percent and Joshua

Question:

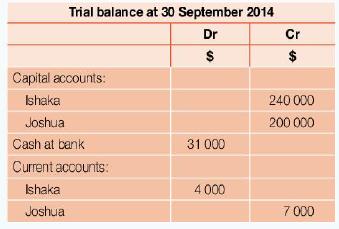

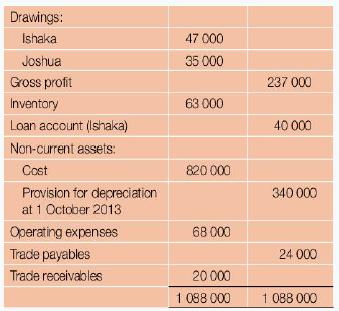

Ishaka and Joshua are in partnership, sharing profits and losses as follows: Ishaka 60 percent and Joshua 40 percent. At the end of the financial year, 30 September 2014, the following balances were extracted from the books of the partnership after calculation of the gross profit for the year.

Additional information:

• Non-current assets should be depreciated by 20 percent per annum using the reducing-balance method.

• Operating expenses due but unpaid at 30 September 2014 totalled $5000.

• The partners have decided that it is necessary to create a provision for doubtful debts amounting to 5 percent of trade receivables at 30 September 2014.

• The partnership agreement includes the following terms:

• Ishake is entitled to interest of 10 percent per annum on her loan.

• Interest is charged on drawings. Interest on drawings for the year ended 30 September 2014 was: 'shake $6000 and Joshua $4000.

• Joshua is to receive a partnership salary of $28 000 per annum.

Prepare:

a. An income statement for the year ended 30 September 2014

b. An appropriation account for the year ended 30 September 2014

c. Partners' current accounts for the year ended 30 September 2014

d. A statement of financial position at 30 September 2014; the statement of financial position should show only the balances on the partners' current accounts at this date.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone