1. Under GASB standards, which of the following would be considered an example of an intangible asset?...

Question:

a. A lake located on city property.

b. Water rights associated with the springs that supply the water to the lake.

c. The city€™s irrigation system, which uses water from the lake.

d. None of the above would be considered an intangible asset.

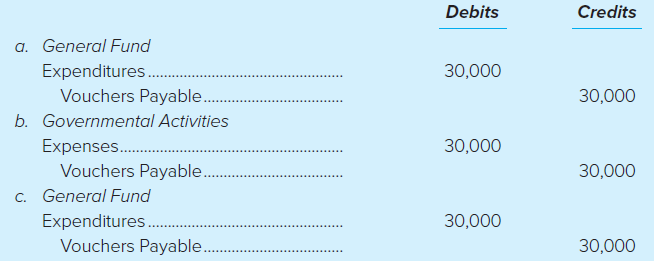

2. Two new copiers were purchased for use by the city clerk€™s office using General Fund resources. The copiers cost $15,000 each; the city€™s capitalization threshold is $5,000. Which of the following entries would be required to completely record this transaction?

3. Maxim County just completed construction of a new town hall to be used for its government offices. The employees have moved in and the new building is officially in use. The county used a capital projects fund to account for the construction of the building, and the building came in under budget. There is a fund balance of $12,000. The county should

3. Maxim County just completed construction of a new town hall to be used for its government offices. The employees have moved in and the new building is officially in use. The county used a capital projects fund to account for the construction of the building, and the building came in under budget. There is a fund balance of $12,000. The county should

a. Transfer the remaining funds to the General Fund to pay operating expenses.

b. Transfer the remaining funds to the debt service fund that will be handling the long-term debt incurred for the construction of the building.

c. Return the excess to the source of the restricted funding.

d. All of the above may be appropriate ways to treat the fund balance.

4. A capital projects fund would probably not be used for which of the following assets?

a. Construction and installation of new shelving in the mayor€™s office.

b. Financing and construction of three new fire substations.

c. Purchase and installation of an entity-wide integrated computer system (such as SAP).

d. Replacing a bridge.

5. Machinery and equipment depreciation expense for general capital assets totaled $163,000 for the reporting period. Which of the following correctly defines the recording of depreciation for general capital assets?

a. Depreciation expenditures should be debited and accumulated depreciation should be credited.

b. Depreciation expenses should be debited and machinery and equipment should be credited.

c. Depreciation expense is allocated and recorded at the government-wide level with a debit to the functions or programs of government and a credit to accumulated depreciation.

d. Because depreciation does not involve the use of financial resources, it is not necessary for the government to record it at the fund level or government-wide level.

6. Which of the following is a correct statement regarding the use of the modified approach for accounting for eligible infrastructure assets?

a. Depreciation on eligible infrastructure assets need not be recorded if the assets are being maintained at or above the established condition level.

b. Depreciation on eligible infrastructure assets must still be recorded for informational purposes only.

c. The government must document that it is maintaining eligible infrastructure assets at the condition level prescribed by the GASB.

d. All of the above are correct statements.

7. The City of Deauville entered into a service concession arrangement (SCA) with Water Wonders, Inc., to operate the city pool for the next 20 years. Water Wonders has agreed to pay the city $3,000,000 up front as a part of this agreement. According to the agreement, Water Wonders will be responsible for operating the pool, and the city will continue to be responsible for costs related to maintaining it. In addition, Water Wonders has the right to collect fees from the public for their use of the pool, although the rates are subject to approval by the city. The city should

a. Remove the cost of the pool and the related accumulated depreciation from its records because it has effectively transferred the asset to Water Wonders.

b. Record the receipt of the cash payment, a liability for the present value of the cost of required future maintenance, and a deferred inflow of resources for the difference between the cash payment and the liability.

c. Record the payment as a cash receipt and as an other financing source.

d. Set up a proprietary fund to record all transactions related to the SCA.

8. Callaway County issued $10,000,000 in bonds at 101 for the purpose of constructing a new County Recreation Center. State law requires that any premium on bond issues be deposited directly in a debt service fund for eventual repayment of bond principal. The journal entry to record issuance of the bonds will require a

a. Credit to Bonds Payable in the capital projects fund.

b. Credit to Other Financing Sources€”Proceeds of Bonds in the capital projects fund.

c. Credit to Other Financing Sources€”Premium on Bonds in the debt service fund.

d. Both b and c are correct.

9. Neighborville enters into a lease agreement for new copiers in all its city hall offices. In the General Fund at the inception of the lease, it should record

a. Leased equipment balances equal to the lease payments made during the year.

b. Expenditures equal to the initial lease payment.

c. Leased equipment balances equal to the capitalizable cost of the lease assets regardless of the amount of lease payments made during the year.

d. Expenditures equal to the capitalizable cost of the lease asset regardless of the amount of lease payments made during the year.

10. Neighborville enters into a lease agreement for new copiers in all its city hall offices. In the governmental activities journal at the inception of the lease, it should record

a. Leased equipment balances equal to the lease payments made during the year.

b. Capital expenses equal to the initial lease payment.

c. Leased equipment balances equal to the capitalizable cost of the lease assets regardless of the amount of lease payments made during the year.

d. Capital expenses equal to the capitalizable cost of the lease asset regardless of the amount of lease payments made during the year.

11. The following balances are included in the subsidiary records of Sinclair:

Town hall building ....................................................... $5,000,000

Town pool (supported by user fees) ......................... 1,000,000

Town pool maintenance equipment ......................... 25,000

Police cars ..................................................................... 200,000

Equipment ..................................................................... 75,000

Office supplies ............................................................... 10,000

What is the total amount of general capital assets held by the town?

a. $5,275,000.

b. $5,285,000.

c. $6,275,000.

d. $6,285,000.

12. Capital assets donated to a government are valued at

a. Historical cost.

b. Net realizable value.

c. Donor€™s book value.

d. Acquisition value.

13. In the Governmental Activities column of the government-wide statement of net position, Bond Anticipation Notes (BANs) are recorded as

a. Short-term liabilities.

b. Long-term liabilities.

c. An other financing source.

d. Either short-term or long-term liabilities depending upon the intent of the government to refinance the liability.

14. Arbitrage rules under the Internal Revenue Code

a. Define the amount of capital assets a government can attain in a given year relative to anticipated revenue streams.

b. Limit the investment of bond proceeds to securities whose yield does not exceed that of the new debt.

c. Specify the interest rate that a government can offer on debt issuances.

d. Determine the deductibility of interest payments made on the purchase of capital assets.

15. Under GASB standards, intangible assets include

a. Computer software internally generated by government personnel.

b. Right-to-use leased assets.

c. Water rights.

d. All of the above.

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented...

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely