Choose the best answer. 1. The members of the Museum Board of the City of Springfield are

Question:

1. The members of the Museum Board of the City of Springfield are appointed by the City of Springfield City Council, which has agreed to finance any operating deficits of the museum. Under these conditions:

a. The museum is a primary government.

b. The city and the museum together are a financial reporting entity.

c. The museum is a special district.

d. The museum is a component unit of the city.

2. Raider City has established a legally separate public financing corporation to issue debt for the city€™s capital projects. The corporation€™s debt will be paid by the city. How should the public financing corporation be reported by the city?

a. A debt service fund.

b. A discretely presented component unit.

c. A note disclosure indicating a related-party relationship.

d. A blended component unit.

3. Which of the following statements is used to determine whether a component unit should be classified as major?

a. Its assets, liabilities, revenues, or expenses are 10 percent or more of the total of all component units.

b. It has a significant financial relationship with the primary government.

c. It is legally separate from the primary government.

d. It is discretely presented.

4. Interim government financial reports

a. Are not necessary because administrators and managers of the government are already familiar with the events and activities of the government on a day-to-day basis.

b. Should be prepared and distributed publicly at regular intervals.

c. Are important for budgetary and cash management purposes.

d. Are not necessary as long as the government prepares a comprehensive annual financial report (CAFR).

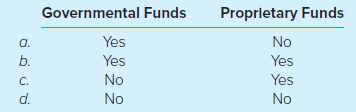

5. The comprehensive annual financial report (CAFR) of a government reporting entity should contain a statement of cash flows for

6. Which of the following terms would be used when describing a primary government?

a. Fiscally independent.

b. Legally separate organization.

c. Separately elected governing body.

d. All of the above.

7. The city council of Lake Jefferson wants to establish a small botanical garden in the city park. The council decided to put aside funds in the amount of $22,000 to build and establish the botanical garden. At the end of the fiscal year, $3,000 of the funds had been spent. How should the remainder of the funds be reported?

a. Committed fund balance.

b. Assigned fund balance.

c. Restricted fund balance.

d. Nonspendable fund balance.

8. Which of the following require a statement of changes in net position?

a. Fiduciary funds.

b. Government-wide financial statements.

c. All governmental funds.

d. Both proprietary funds and fiduciary funds.

9. What are intra-entity transactions?

a. Nonexchange transactions between a primary government and its component units.

b. Exchange or nonexchange transactions between a primary government and its component units.

c. Nonexchange transactions between a primary government and any discretely presented component unit.

d. Exchange transactions between a primary government and any blended component units.

10. Which of the following would not be included as a reconciling item in reconciling the governmental fund statement of revenues, expenditures, and changes in fund balances to the government-wide statement of activities?

a. Bond issue reported as an other financing source in a governmental fund.

b. Interest accrued on long-term notes payable.

c. Acquisition of capital assets reported as an expenditure in the governmental fund financial statements.

d. Interest accrued on Property Taxes Receivable€”Delinquent.

11. A positive unassigned fund balance can be found in which of the following funds?

a. Special revenue fund.

b. Debt service fund.

c. General fund.

d. All of the above.

12. A city established a special revenue fund for gas tax revenues that the state has indicated must be expended for street construction, maintenance, and repair. How would the fund balance for the special revenue fund be classified?

a. Committed.

b. Assigned.

c. Restricted.

d. Unassigned because this involves tax revenues that are always considered general revenues.

13. The county commission passed into law through an ordinance a requirement to set aside 5 percent of the county€™s tourism taxes for tourism campaigns to be started in the upcoming fiscal year. How would the 5 percent in tourism tax revenues be classified in the county€™s fund balances at the end of the current fiscal year?

a. Committed.

b. Assigned.

c. Restricted.

d. Unassigned.

14. The GASB has undertaken a major project that could have a significant effect on government financial statements. Which of the following statements concerning the project is correct?

a. The project has the potential to affect how governmental funds are reported.

b. The project has the potential to affect how governmental funds and governmental activities are reported.

c. The project has the potential to affect how governmental and proprietary funds are reported.

d. The project relates to changes in the number and type of notes to the financial statements.

15. Which of the following is generally considered a special purpose framework that is used by governments?

a. Accrual.

b. Budgetary.

c. Cash.

d. Reserve cash.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely